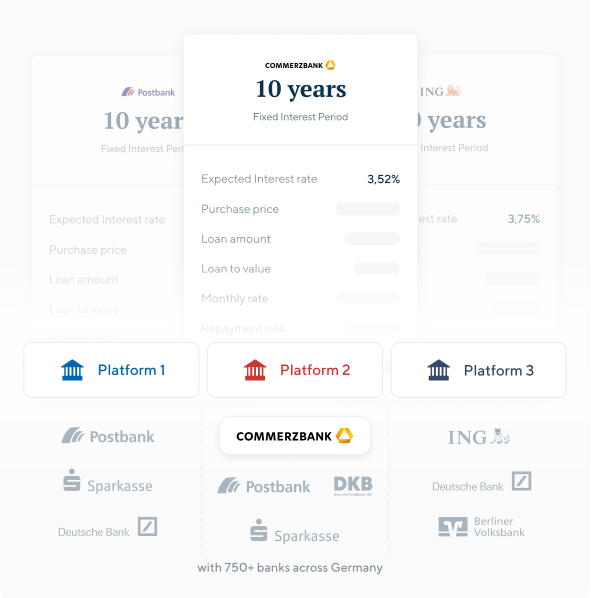

We compare all mortgage platforms

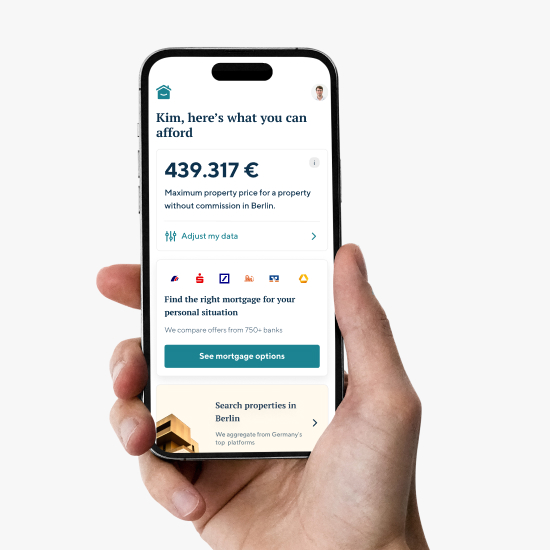

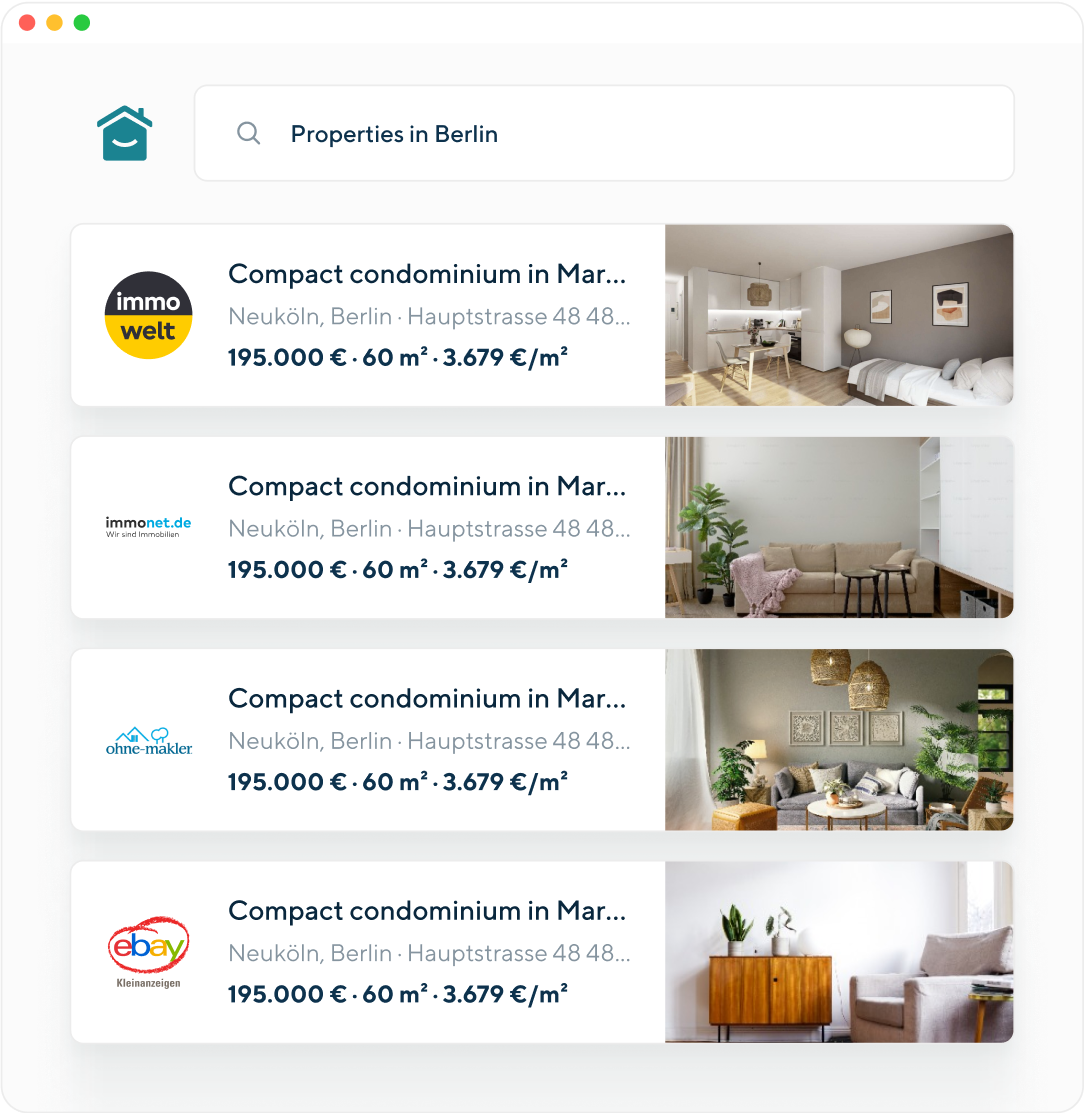

We compare offers from 750 banks to find you the right mortgage, while most brokers compare only 500 banks.

Most brokers just use a single platform.

We had an amazing experience with Hypofriend! They helped us secure our mortgage quickly and smoothly, guiding us through every step of the bank process with clarity and confidence.

Panos