Sondertilgung: A popular but overrated option

Who doesn't like the idea of being able to repay extra on their mortgage? That is what “Sondertilgung” is. But is it a good idea?Updated on July 15, 2025

Why is Sondertilgung, by and large, a dead option?

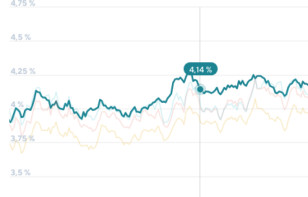

First, when interest rates are low, you should not repay your mortgage but invest in higher-yielding assets like stocks (through cheap, well-diversified ETFs) or save for a second home to rent out. If you earn 1–4 % on repaying your mortgage but can earn 5 to 7% elsewhere, it typically is not a good idea to repay. Of course, you need a long enough time horizon. So for most people under 60, I would strongly encourage alternative investments that help them save for their life expectancy of 90+ years.

Second, when interest rates go up considerably at some point during your mortgage, it can become a good idea to repay extra on your mortgage—but not using Sondertilgung.

At that point, you have three better options.

Put the money in a bank account – for example, at a fixed-term deposit that runs to the end of your fixed interest rate period. You can do this when the bank pays you a higher rate than the interest rate you save on your mortgage (for example, if they pay 3% and your mortgage interest is 1%). When your fixed interest period runs out, you take the money from the bank and use that to reduce your loan size.

Get yourself a BSV (Bausparvertrag). While this is generally not a good option when you buy a home, it is one of the best options for reducing your interest risk. Here is how it works. You save each month into the BSV. Then, ideally, when the fixed interest period runs out, you get 2,5 times the saved time paid out and use that to reduce your mortgage. So if you save 20.000 €, then you get 50.000 € to reduce your mortgage. Of that amount, 30.000 € is a very low-interest loan. For nearly everyone, this is more financially attractive than repaying the loan through Sondertilgung.

Indeed, invest in higher-yielding options, like ETFs. You should, in the long-term, be able to obtain returns close to 7 % after cost and tax if you invest wisely and cost-effectively. This, in the end, will yield far better results, and you want to consider it unless you are really worried about being able to pay the higher interest rates when your mortgage rate raises. We have created Pensionfriend so you can invest at low-cost and high returns and secure your financial future.

What option is best for you? We can calculate your savings using the different options, including the impact of taxes and your long-term financial well-being. It can make quite a difference.

Is Sondertilgung, at the present juncture, an entirely bad idea?

No. It does have an interesting potential benefit. If you had to sell your house before your fixed interest rate period is over (and less than 10 years after getting the mortgage), it does reduce the early departure penalties.

As you may know, the bank charges you a penalty if they earn less on reinvesting the mortgage money that you repay early. However, the banks must deduct the potential unscheduled repayment from the penalty base, since they must assume that you will use the option.

Say you have five years left on a mortgage, then a Sondertilgung of 5% per year could reduce your average balance for years 6 to 10 by about 15%.* This would hence reduce your penalty by about 15%. Not much, but still some benefit.

* The precise percentage is difficult to calculate. It depends on the extent to which you have already repaid your mortgage and is higher than the simple average as it assumes you would pay the Sondertilgung as soon as you can each year.

Calculate your mortgage options

Use Hypofriend’s mortgage calculator to calculate your mortgage options in Germany.

In conclusion, the main benefit of getting Sondertilgung on your mortgage in the current low-interest environment is that it can save you a bit on the penalty if you sell your house early.

If that doesn't apply to you, you are better off investing your money in higher-yielding assets like stocks. If you are worried about being able to pay the higher rates after your mortgage interest rate resets, then you are best off with a Bausparvertrag.