How to Find the Best Interest Rates on Your Mortgage

In this article, we show how to secure the best rates and what traps to avoid. Keep in mind that it is also about the best advice, as the wrong mortgage--especially fixation, but also the repayment rate and down payment--can cost you dearly.Updated on July 15, 2025

Recognizing the Flaws of Online Interest Comparisons

Nearly all online comparison tools display unrealistic rates designed to lure you in.

These rates often assume ideal conditions—such as top-tier energy efficiency, the highest SCHUFA score—conditions that rarely reflect real-life situations. They also tend to assume German residency and fluency in German, which makes a difference in the rates available.

Additionally, the best rates may be from banks that systematically reduce the value of properties, when making actual loan offers.

In some cases, the wrong rate is displayed with the proper rate including all costs being much higher—for instance, as seen with so called BausparVertrage or Bank Savings contracts.

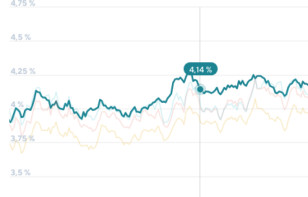

As a result, these comparisons rarely reflect true costs. Because these factors are not visible in online calculators, working with a broker is essential, especially one that knows the conditions, including those special to expats. The real challenge, therefore, lies in finding a trustworthy and effective broker. You can find the current mortgage interest rate in Germany here.

How Many Banks Are Really Considered

The first step is finding a broker that compares many banks and uses all the key platforms. In Germany, three leading platforms—Europace, eHyp, and BAUFINEX—aggregate offers from hundreds of banks, each covering different lenders with some overlap.

The largest brokers Dr. Klein and Interhyp use only one platform. Specifically, Hypoport owns Dr. Klein and uses the Europace platform, while ING owns both Interhyp and Ehyp, with Interhyp exclusively using the Ehyp platform. This single-platform reliance limits their ability to fully compare mortgage rates in Germany.

At Hypofriend, we integrate all three major platforms, allowing us to pull rates from over 750 banks. Our advanced technology automatically checks each platform, ensuring we can offer you the most competitive rates.

Research from major platform Europace also shows that despite having access to hundreds of banks, nearly all advisors use just 3 to 5 banks they know well. As we have good technology, we use many banks.

Does Hypofriend have favorite banks? Definitely. When their rates and other conditions are good, we shift our clients' business to those banks that offer them. Because conditions are not static, we continuously adjust our offers and shift our business to where it is best for our clients.

We typically don’t recommend using your own bank: we can show you what rates they offer on the platforms and you can see if they are competitive and compare it with the rates they offer to you. Only a few banks actually use a platform, and then it is rarely more then one platform.

Calculate your mortgage options

Use Hypofriend’s mortgage calculator to calculate your mortgage options in Germany.

Make Sure Your Advisor is in the Know

Knowing the tricks of the trade

Ensure your advisor knows all the tricks banks apply to present their rates on the platforms.

Our advisors know the banks (or branches of banks) that use these tricks and adjust the rates. Occasionally, these banks are still the best, but more often, they are not. We also run models to calculate more complex rate adjustments, such as in the case of the Bausparvertrag.

Customized Mortgage Solutions

While personal circumstances (employment status, Schufa score) affect mortgage options for everyone, the search for the best rate is complicated, especially for expats. Some banks apply additional criteria, like speaking German, which we sometimes resolve with a translator. All banks apply residency criteria, but they differ greatly by bank. For example, whether the spouse's income on a temporary visit counts.

Our advisors are trained to know these conditions. We talk directly to banks' credit departments and track the conditions separately. If a new condition emerges or is relaxed, we share it in weekly meetings on learnings.

Beyond the Interest Rate: The Value of Advice

Stress how professional brokers help borrowers navigate hidden conditions or insurance add-ons.

Hypofriend offers transparency by comparing multiple offers objectively. Banks sometimes use sneaky tactics to improve their mortgage rates on comparison platforms. For example, a branch might offer a low rate but later adjust the property valuation or bundle in products like a Bausparvertrag that increases costs over time. Hypofriend advisors track these tactics across different lenders and analyze whether certain banks truly offer the best mortgage rates in Germany or if the advertised deal has hidden strings attached.

Customized Mortgage Solutions

Personal factors—like Schufa for mortgage, residency status, or even language requirements—can affect an expat’s mortgage in Germany. Some banks won’t accept foreign incomes; others require a translator if you don’t speak German. Our advisors work closely with credit departments to keep up with ever-changing criteria, ensuring we can guide you to the right lender.

Calculate your mortgage options

Use Hypofriend’s mortgage calculator to calculate your mortgage options in Germany.

Beyond the Interest Rate: The Value of Advice

A professional German mortgage broker helps you navigate hidden conditions or unwanted insurance add-ons. At Hypofriend, we offer transparency by comparing multiple offers objectively so you can be confident you’re choosing the right mortgage for your unique situation.

Next Steps

Check-in with an Advisor Early

Connecting with a mortgage advisor early on is crucial to get a realistic, property-specific rate quote. Interest rates can change quickly, and an advisor can easily update your offer if the market shifts, or you find a different property. At Hypofriend, we monitor market trends, but securing a well-priced home usually outweighs waiting for a slight rate fluctuation.

Check Affordability Early

Knowing how much mortgage you can comfortably afford is essential. Speak with a Hypofriend advisor to uncover potential red flags—like Schufa issues or insufficient down payment—and take steps to improve your affordability before committing to a home.