What’s the role of SCHUFA in getting a mortgage?

SCHUFA is Germany's largest credit agency and calculates credit scores that are used by banks when deciding on a mortgage.Updated on May 19, 2025

- Why does SCHUFA matter?

- What is the problem with SCHUFA?

- What is the SCHUFA?

- What is the SCHUFA credit score?

- The best way to get a SCHUFA report

- How do you read the SCHUFA report?

- What you need to be aware of when approaching a mortgage broker!

- 11 Tips to improve and maintain your SCHUFA score

- Summary

In this article, we explain what SCHUFA is and why it is so heavily criticized. We will also give you advice on how to improve and maintain your SCHUFA Score and clear up some myths.

Why does SCHUFA matter?

Most banks want to understand your payment 'morale', as it is a major input in the risk that you default on your loan. On the one hand, banks look at objective factors such as your income and assets and the value of the property. These are important factors for them.

On the other hand, they also want to know how likely you are to run into financial difficulties for other reasons. Your past payment discipline is a key factor for most banks. But instead of gathering information themselves, which would be a major undertaking, it is more efficient for them to rely on an external party to assess your risk. In Germany, the dominant external party is SCHUFA. And this is where the problem starts.

What is the problem with SCHUFA?

Unfortunately, the SCHUFA scoring is a black box. While advanced rating agencies like the US one have taken a view that customers benefit from understanding their score, so they can improve their financial behavior, SCHUFA still treats its score as a trade secret.

This means we can give you advice based on what we have puzzled together, but it cannot be definitive advice, as SCHUFA is not transparent. Even the legal restrictions that the Bundestag and law courts have put in place to curb some practices, such as allowing only the recording of selected payment arrears, can be circumvented in practice.

The good news is that we (and some industry followers) have cobbled together:

Information on the cut-off point most banks use.

Advice on how to prevent negative scores and some suggestions to improve your scores.

Good advice on finding out your score in detail so you are aware in a timely way.

A method to avoid the mortgage application worsening your score or even undermining your getting a mortgage.

We do know banks that weigh SCHUFA as less important and can make exceptions when other parameters, e.g., income and savings, are positive.

Now you know why the SCHUFA matters and what the problem is. Before we continue, let's take a step back and explain in some more detail what SCHUFA is.

What is the SCHUFA?

The SCHUFA is Germany’s largest credit agency and was founded in 1927. It is a joint institution of German credit institutions and other lending commercial enterprises to protect its members from losses in the credit business.

The name is short for “Schutzgemeinschaft für allgemeine Kreditsicherung”, which roughly translates to “Protective association for general credit protection”. Fun fact: The word SCHUFA is a synonym for creditworthiness in Germany.

Whenever someone refers to your SCHUFA score, SCHUFA report, SCHUFA rating, and so on, they’re talking about the same thing – your “SCHUFA Auskunft”– credit information that will follow you for the remainder of the time you live in Germany.

How does a SCHUFA entry happen?

For many German people, a SCHUFA entry is always negative. But that's not the case at all. A SCHUFA entry occurs, for example, when you sign a mobile phone contract, open an account, or take out a mortgage. Such entries are positive SCHUFA entries.

Negative SCHUFA entries occur when a person's payment behavior is unreliable. This is the case, for example, if installments are paid late or not at all. Anyone against whom an enforcement order has been issued also has a negative SCHUFA entry. With such a particularly negative SCHUFA entry, a mortgage is nearly impossible.

The data for the entries comes from public registers on the one hand and is reported by SCHUFA's partners on the other.

SCHUFA collects, stores, and processes for example:

information on current accounts, installment credits, credit cards,

information on undisputed, due, and repeatedly reminded or titled claims, as well as their settlement,

information from public debtor lists and official notices,

score values and

personal data, such as your birthday or address.

They don’t track your income or your savings.

What is the SCHUFA credit score?

There is not that one SCHUFA score. There is the “SCHUFA-Basisscore” and several industry scores, of which no one knows exactly how they are calculated.

However, what we know is that the “Basisscore” is recalculated every three months and provides a percentage value between 0 and 100. In the following table, you can see the forecast for the probability of default and the corresponding score level.

If you are now wondering what a good SCHUFA score is, we are sorry to disappoint you. There is no perfect answer to this question, as each bank determines this itself. However, we know from experience that banks with strict guidelines do not grant loans with a score of 95%.

The industry scores, including one for banks, savings banks, cooperative banks, and mortgage businesses, differ from the basic score. This is understandable insofar as the assessment of risks for payments on account in retail must be evaluated differently than those for a real estate loan.

The SCHUFA mortgage business score (version 3.0) is expressed in points. The scale ranges from 0 to 999 points. The higher the score, the lower the default risk for the bank. SCHUFA has introduced rating levels from A to M, with the risk ratio being lowest in level A at 0.17 percent and highest in level M at 20.55 percent.

The score indicates the probability of non-payment occurring within the next 15 months.

The best way to get a SCHUFA report

There are three different reports that you can order directly from SCHUFA. We recommend getting the free data copy report now. You can always get an update.

Now, let’s take a look at the three reports:

1. free data copy (“Datenkopie nach Art. 15 DSGVO”)

Like every other company, the SCHUFA has to provide you a copy of all the data they have stored about you. It will be sent to you by mail after you have ordered it on the SCHUFA website. This may take some time, so order your copy on time, as it is the most detailed actually and hence the most insightful, and especially do so if you have any doubts about your creditworthiness or are worried about any negative scores.

By the way, don’t get fooled. Many claim that you can apply for the free data copy only once a year. But this is not true. The DSGVO does not specify a specific maximum number of possible requests. You can get one every three months when your score is recalculated.

2. SCHUFA credit report (“SCHUFA-BonitätsAuskunft”)

The SCHUFA credit report consists of two components: a certificate and an overview of all the data stored about you at SCHUFA. It costs a one-time fee of 29.95 euros and can either be ordered on the SCHUFA website or printed out at special SCHUFA terminals in Postbank branches.

3. SCHUFA creditworthiness check (“meineSCHUFA kompakt/plus/premium”)

SCHUFA also offers an online creditworthiness check. This is a paid subscription, for which you have to register on the SCHUFA website. This digital SCHUFA credit check is not only the most expensive, but not even suitable for proving your creditworthiness to the bank. Reason: The data is only visible after login.

How do you read the SCHUFA report?

Your SCHUFA must be interpreted correctly to understand it. We are going to show you how to do that with the free date copy, which consists of several pages.

Page 1 & 2

The first two pages contain general data about you, such as name, your address (and former addresses), date of birth, and so on.

Page 3

Now it gets interesting. The third page gives you an overview of the companies that have requested your credit history and which companies have stored data in your SCHUFA record. The records contain the date of the date request or storage, the name of the company, and the data type which they requested or stored, like credit card data or bank account.

Page 4

This page is all about your scores. The first table shows your company's industry score. In this example, the latest entry is from the ING about a condition request. It shows a score of 92.94% for the bank score, meaning a favorable to increased risk.

After that, you find your “Basisscore”. That’s probably the most important figure in the SCHUFA report, as it shows how reliable you are in terms of financial obligations. In the example below, the overall score is 95.22%, which is a low, manageable risk.

Page 5 & 6

The last pages contain additional information on how the SCHUFA works and how they do the scoring. Of course, they don’t explain it in detail.

What you need to be aware of when approaching a mortgage broker!

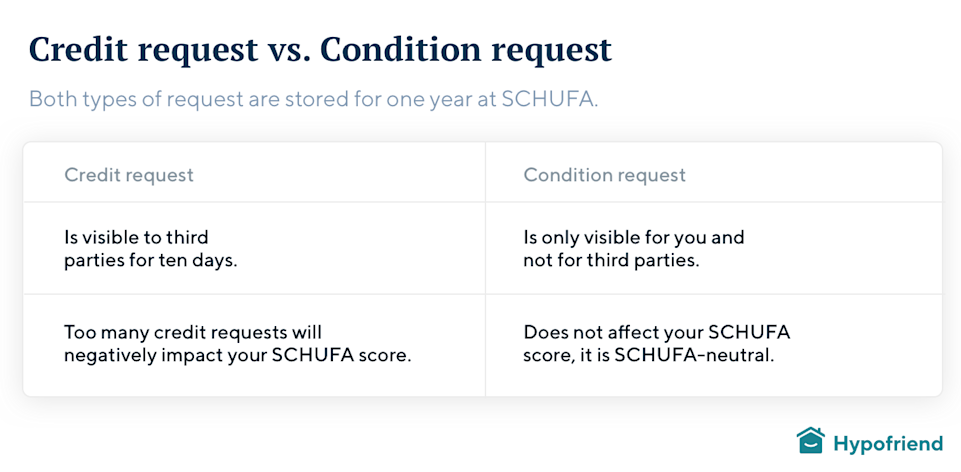

Mortgage brokers and banks can make two types of requests to SCHUFA that affect your score differently.

SCHUFA Kreditanfrage (Credit request)

A “Kreditanfrage” (credit request) is stored in your SCHUFA report for one year and is visible to third parties for ten days. What does that mean for you? If you (and therefore the banks) made several credit requests, other banks can see these and, in the worst-case, rejections. This will also cause other banks to turn you down or offer you a loan with interest rates that are far too high. In addition, your SCHUFA score will drop. And that, in turn, can lead to your financing request being rejected. It's a vicious cycle.

SCHUFA Konditionsanfrage (Condition request)

The better way is a “Konditionsanfrage” (condition request). The condition request is also stored in your SCHUFA report for one year, but it is only visible to you and not to third parties such as banks. Accordingly, condition requests do not influence your score. They are SCHUFA-neutral.

At Hypofriend, we make sure that a SCHUFA-neutral condition request is made when we pre-check your eligibility with our partner banks. A credit request is made only when you accept the binding financing offer from the bank.

Before sending any requests, check your mortgage options with our German mortgage calculator.

11 Tips to improve and maintain your SCHUFA score

Unfortunately, you can’t improve your SCHUFA score overnight. However, you can take some basic steps to improve your creditworthiness over time by following these tips.

Get your free SCHUFA report, check entries, and have old and wrong entries deleted. SCHUFA must correct such entries as soon as possible and delete them from your file if necessary.

Repay your credit loans and close them. Even if they have zero balance, they count: closing them improves your score. This action has the clearest impact on your credit score.

Cancel unnecessary (German) credit cards and bank accounts. SCHUFA evaluates the possession of more than two credit cards negatively, as it is assumed that you might have financial problems and only, therefore, have several cards. The same goes for too many bank accounts.

Cancel unnecessary and outdated contracts. Examples are phone contracts, in which you pay for the acquisition of the phone, as this is regarded as a debt. You should cancel old contracts that you no longer need.

Consolidate small loans. If you have several small loans, it's better to consolidate them into one larger loan.

Here are a few tips on how to keep your good SCHUFA score. Keep in mind that it is easy to ruin your score and hard to build it up.

Pay your bills and installments on time. Not paying bills is the sure way to kill your score. Not every bill that you pay late will be recorded directly in your SCHUFA file, and in case of doubt, you may need to consult a lawyer.

Don't add to your credit loan balances. Every increase is reported. Instead, make additional payments to reduce your balance.

Make condition requests (“Konditionsanfrage”) instead of credit requests (“Kreditanfrage”). Remember what we discussed: condition requests are SCHUFA-neutral, and many credit requests will hurt your score badly.

Don't take out too many (small) loans. Taking out loans, even for small amounts, hurts your SCHUFA score. Repaying them improves your score. Indeed, getting a small loan and then repaying it can actually improve your score over time, but be careful with this strategy.

Avoid frequent bank account changes. SCHUFA rates frequent account changes negatively.

Protect yourself from fraudsters' misuse of your data. Unfortunately, it is becoming increasingly common for criminals to go shopping online with a stolen identity. Open bills are not paid, and corresponding collecting procedures worsen the SCHUFA score of the identity theft victim. As soon as you notice that your identity has already been misused, you should report it to SCHUFA free of charge and have your data cleansed.

Summary

Your SCHUFA scores play a big role in getting a mortgage in Germany. Banks don’t gather information about your past payment discipline. They use the SCHUFA to assess your risk.

The problem is that the SCHUFA is a black box. No one knows exactly how they calculate the “SCHUFA Basisscore” or the different industry scores. Therefore, it’s hard to give definitive advice on how you can improve and maintain your score. The best way to maintain a good score is to pay your bills and installments in time, to repay any (small) loans, cancel any credit lines, cancel unnecessary (German) credit cards and bank accounts, and check your SCHUFA report for old or wrong entries and have them deleted.

To ensure that everything goes well with your mortgage, you should order your free SCHUFA report well before you apply so that any problems can be identified at an early stage. And don’t worry. You are allowed to get more than one free report per year. Tip: the free report is the best.

If you're not sure how to interpret your SCHUFA report, don't be afraid to ask your Hypofriend advisor. Our experts will be happy to help you. Schedule your free consultation with one of our mortgage experts.