8 Ways to Increase How Much House You Can Afford in Germany

Find out how you can increase your affordability in times of high property prices and skyrocketing interest rates, and thus afford your German dream home.Updated on November 17, 2025

1. Buy a Property With a Second Person

Buying a property with a second party – so-called co-signing – can be an excellent way to increase affordability. While Co-signing is much more common in the US where interest rates are 6 %+ and affordability has been tight for much longer, it can also make a lot of sense when buying a property in Germany.

By combining your incomes, you may be able to afford a property that would be out of reach on your own. Plus, splitting the mortgage and other costs with another person can make homeownership more manageable. Keep in mind that you don't need to be married to buy a home together. You can even do it with a sibling or a friend. But you should look for a partner who lives and earns their income in Germany. This is important so that the banks classify the person as creditworthy.

There are several ways to co-sign:

If you and the second person both sign the purchase contract and the mortgage contract, you share the risk of the loan and get part of the property yourself.

Only by signing the mortgage together, but only one of you signing the purchase contract, you share the loan, but only one of you will actually own the property. Usually, this is done with a family member who basically helps out as a guarantor. Please note that many banks do not allow this approach because it poses a risk to the person who signs the mortgage but is not the owner.

Signing the purchase contract together, but only one gets the mortgage contract is done when one person is not accepted by the banks, for example because of residency permit, income source issues (tax foreigner / self-employed with bad results recently, etc.). This means that one of you can take out the loan, but the property is still owned by both of you.

However, beware that co-signing the mortgage contract will mean it will be entered into the SCHUFA credit score of both of you.

Also, signing with a friend or family member should always be done through a proper contract that outlines each person's responsibilities and obligations. Disagreements between the owners can lead to problems with repayment and end up in court. Unfortunately, this can happen even among the best of friends and closest families.

If you buy with a partner and only one of you moves in, there may be tax implications for the other person. Please check with a tax advisor to see what you need to consider.

Find a mortgage that fits your needs

Our recommendation engine calculates your optimal mortgage by comparing hundreds of lenders and thousands of loan options.

Find the right mortgage2. Buy a Fixer-upper

Another strategy to maximize your affordability is to consider buying a fixer-upper. These properties are often sold discounted because they need some work. However, with some so-called “sweat equity”, you can add value to the property and increase its worth. When considering a fixer-upper, you must do your due diligence and ensure that the renovations you plan to make are worth the investment. Consider hiring a home inspector to help you identify any potential issues with the property before you buy.

You should also be honest with yourself and realistic about your abilities and resources for crafting. How much time can you actually devote to it? What work can you do yourself? And for what, would you need the help of professional craftspeople? Do not underestimate the cost of outside help and the considerable cost of materials and tools.

3. Buy a Rented Property

If you're willing to take on a tenant, buying a rented property can be a cost-effective way into homeownership. Tenanted properties are often sold for significantly less than their market value because professional investors cannot claim the apartment or house for their own use, and the rental yield may be undesirable. Find a property that has a young, healthy tenant and discuss the possibility of a property switch with them. You may be able to negotiate with the tenant and offer them 1-5 % of the purchase price as a settlement agreement. Keep in mind that it's essential to follow all legal procedures and regulations when buying a tenanted property.

In our article, you will find out more about the opportunities and risks of buying a rented property. Should I buy a tenanted property for my own use in Germany?

4. Rent a Room Out

Buying a property with an extra room and renting it out can help you cover the initial cash flow so that the flat comes at a lower cost every month. You can use platforms like Airbnb to rent out a room for a short time or find a long-term tenant through sites like WG-Gesucht.

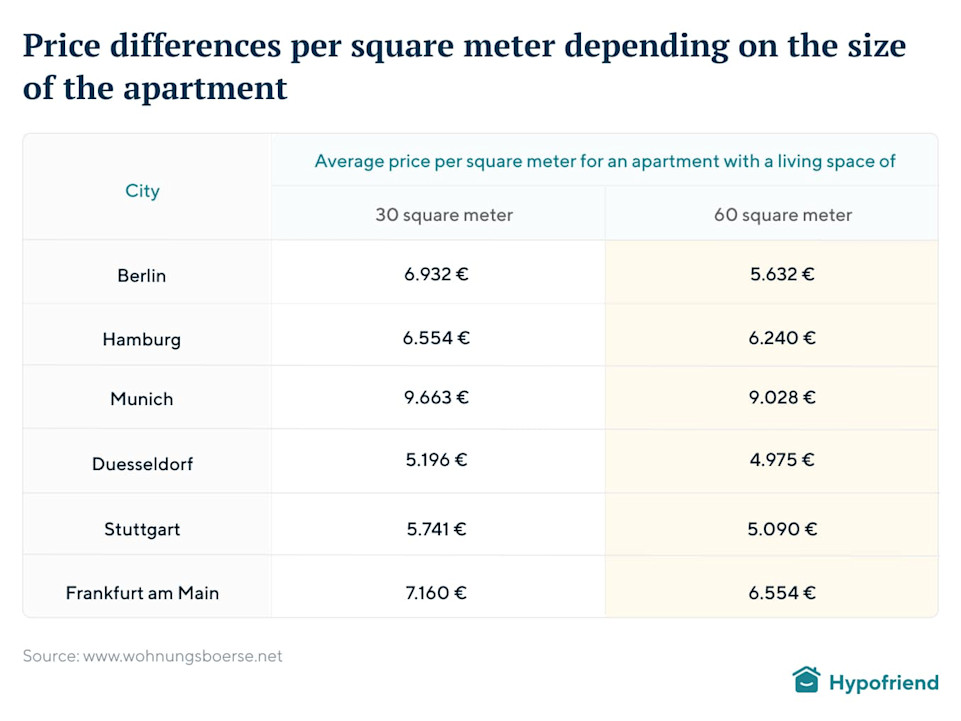

Not only can you increase your overall affordability, but you can often get a better deal, as the price per square meter is often significantly lower for larger properties. This is especially true in large cities and metropolitan areas, where there are usually many students and single households. Especially if you are thinking of buying a small flat as your first step on the property ladder, it may be worth thinking a little bigger than a 1-bedroom:

5. Use KfW 3-Year Repayment-Free Option

KfW (Kreditanstalt für Wiederaufbau) is a German government-owned development bank that provides loans for various purposes, including home buying. As a first-time homebuyer, you can use “KFW-Wohneigentumsprogramm” or short KfW 124 to partially cover the loan, which helps to reduce the interest rate on the main loan. However, an often overlooked feature is that they also allow you to delay repayment for up to three years (default is always one year). This can be helpful if you've just started work and want to create more free cash flow. Keep in mind that interest will still be charged during the repayment-free period, so it's important to budget accordingly.

6. Make Sure All High-Credit Loans Are Paid

Before you start your home-buying journey, make sure you have paid off any high-interest loans before looking for a mortgage. Unsecured loans, such as student debt or private loans, often come with a higher interest rate. You'll be better off buying a used car than leasing one, for example. Paying off these debts can improve your debt-to-income ratio and help you qualify for a more favorable mortgage.

Sometimes, private loans can not only lead to more expensive interest rates on a mortgage but can even prevent banks from lending to you at all. You can read more about this in our article What’s the role of SCHUFA in getting a mortgage?

7. Use Existing Properties

Do your parents or grandparents own a home in Germany or elsewhere? Is it completely paid off and debt-free? Leveraging a property, which means borrowing against the 'home equity' inside of it, is a great way to afford a first home or a bigger home. That is why the notion of getting on the 'property ladder' was created.

Speaking of parents and grandparents, if your family is fortunate enough to be financially secure, they can help you buy a family in a number of ways. Show them our article on helping your kids buy a home in Germany, and maybe you can talk about how they can support you in fulfilling your dreams.

8. Build Your Own Home

In Germany, you only pay property transfer tax on land, so if you buy a plot of land and build on it in Berlin, you only pay 6 % on the land and not on the materials and labor. But beware, the land isn't cheap, even though you should be able to negotiate the price for the land quite significantly given that the demand from people who build their own houses has decreased significantly (lower than for buying existing properties).

Ideally, you should hire a general contractor to deliver a turnkey solution at a pre-fixed price. This price should be notarized so that you have leverage in case the contractor wants to charge you a higher price later on. It is absolutely advisable to keep extra savings aside for additional costs that are almost guaranteed to come up during the construction process. If you go down the route of building yourself, you should explore pre-fabricated houses, as those can already start at around 200k.

If you are willing to take on the challenge of building your own home, you may be able to save money on property transfer taxes. In Germany, you only pay property transfer tax on land, so if you buy a plot of land and build on it, you only pay 3,5-6,5 % on the land (depending on the federal state) and not on the materials and labor.

You can use our purchasing cost calculator to determine the cost of buying a plot of land.

So, even if owning a property in Germany may seem unattainable due to the high prices and skyrocketing interest rates, there are ways to make it happen. By following the tips above, you can increase your affordability and, hence, your chances of finding a property that fits your needs and budget. Make also sure to follow our Step-by-step guide: How to buy property in Germany for the shortest path to your German dream home. Good luck on your journey to becoming a homeowner in Germany!