Helping your kids buy a home in Germany: When is this a good idea?

Young adults often struggle with too little equity when trying to buy property in Germany. Learn what options parents have to help.Updated on July 15, 2025

- 1. Why, and if so, how much does it make sense for your children?

- 2. Is a gift for house buying the best way to support your children?

- 3. Can you afford it, and is it better to make a gift or to extend a loan?

- 4. Using your own house as collateral?

- 5. Last but not least, the emotional side of giving

This article sets out how you can quickly calculate if it makes sense to help your children buy their own homes. It provides some practical tips as to the size of your gift or loan in Germany and for making it a bit more of a two-way event rather than you just being the generous one…

But first, let me tell you my personal background story: My mom helped me buy my first home, and it made a huge difference. That 10K gift 40 years ago allowed me to leverage my first salary (and that of my future wife) into a first house and then, later, with an additional gift into a larger home. I estimate that I earned about the equivalent of ⅔ of my salary from these houses in after-tax capital gains, and this has allowed me to do the same in return for my three kids.

Let's go over the numbers to understand why and when it makes sense to help your offspring.

1. Why, and if so, how much does it make sense for your children?

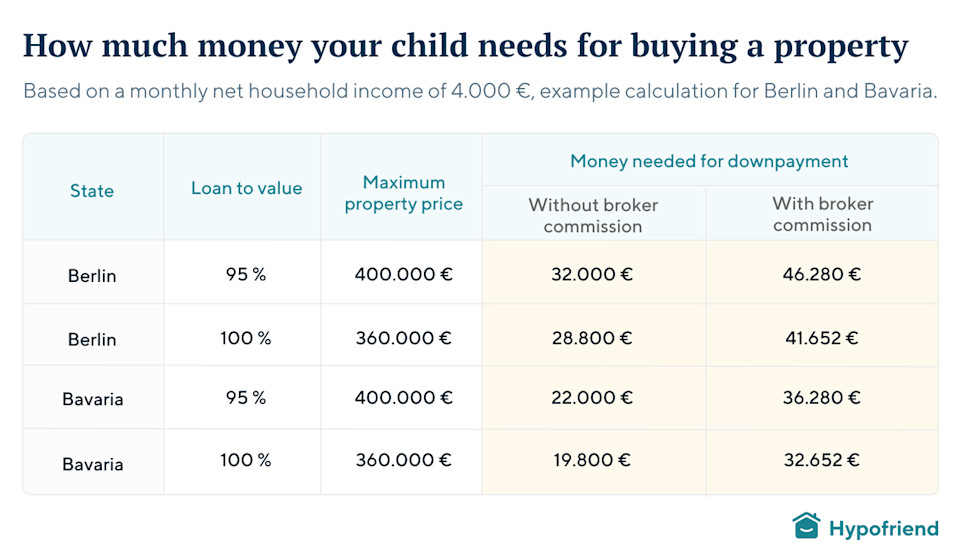

Typically, when you are young, you only start having a decent income after a few years of work (if you are university educated, and only later if you have a vocational type of job). But when you are young, you usually lack any meaningful savings. In Germany, you need to bring in a lot of savings to buy a house, about 10% of the purchase price, and more if you want to have a reasonable interest rate. With your equity, you usually cover the purchase costs, which include a 2 % notary fee, 3-6,5 % transfer tax, often 3,57 % real estate commission, and ideally 5 % extra to reduce the loan value and get a better interest rate.

For many young people, raising that equity without parental support is a major hurdle.

In contrast, in Germany, the income of young people goes far. They can leverage their monthly income about 100 times at current interest rates and with a loan-to-value ratio of 95 %. For example, if your child and his/her partner earn 4.000 € net per month, they can afford a 400.000 € house that requires a minimum of about 40.000 € in savings to buy.

These figures change accordingly with higher or lower income. For example, if their income is 6.000 € per month, you can add 50 % to these numbers. And if their income is 3.000 € net, then you can multiply the numbers by ¾. And sometimes your children need more. For example, if a house requires renovation, it can often make it a good deal. In any case, this gives you an indication.

2. Is a gift for house buying the best way to support your children?

In our rent vs. buy calculator, you can see the impact of buying a house vs. renting on your net wealth. In short, you gain the rent (usually rents are about 3 % of the property prices in Germany), and the appreciation of the property (3 % in the long term is our conservative estimate and this is tax-free under easy-to-meet conditions). On the negative side, you have to pay interest and maintenance (about ¾ %) and have to write off the fixed costs. If interest rates and maintenance amount to 4 % annually, the typical homeowner stands to gain about 60% of the house value over 15 years. That means they can quintuple the value of your gift in that period. You would have to earn a return of 10% after tax to help them more in 15 years with a cash gift.

In 30 years, they could have a 20-fold increase in your gift under these assumptions, whereas you could, compared to an expected stock market return of 6 %, quintuple your potential gift.

Therefore, if you want to have your money go far, you are better off supporting your children sooner than later with a house purchase.

From a more parental strategic perspective, your children themselves also have to save more (in the form of repaying their mortgage), and they will have to keep earning a good income to pay for the mortgage, keeping them on the right path :) Over time, they will accumulate wealth through the valuation increase in the home while avoiding paying ever-increasing rents, so you help them create a safe financial future in addition to a lovely home for them (and any possible grandchildren).

Your kids can also not just decide to spend the money on frivolous things. You do, of course, always have to consider if they are ready for homeownership. It is, in any case, wise to discuss contingencies, like renting the house out when they want to move.

3. Can you afford it, and is it better to make a gift or to extend a loan?

In our pension gap calculator, you can determine how well you are prepared for your own pension in Germany. If you have no gap after reducing your savings by donating the required amount, that is a clear sign that you can afford a gift.

Regarding the loan vs. gift question, banks make that decision for you. In Germany, banks want to be assured that they get their money back and want to see evidence that this is a gift. Also, please keep in mind that you will have to report this gift to the tax office and that a notarization is needed if it could be contentious among siblings.

You can, of course, agree on a non-binding (and not notarized) side contract where your child pays you back, for example, in case of hardship or if they sell the house with a substantial profit. Given the substantive gains they will have, they are likely to be in a much better position to support you in old age. You may want to discuss this with your children openly so your expectations are synchronized. It can help to write it down to clarify, but using the law to enforce your agreements with your kids may not feel very good.

4. Using your own house as collateral?

If you have the liquidity available, then you have an easy source. Most people, however, don’t have such amounts readily available, but they often have a house with a modest mortgage.

Then you have two options:

Borrow against the house

Use the house, provided it is in Germany, as collateral for the loan.

From the bank's perspective, these options are quite equivalent. However, you need to keep in mind that if the house is used as collateral, you will not be able to sell it until the collateral is eliminated. So, if you want your freedom, it is better to take out a second mortgage on your house. If you are close to the end of your fixed interest period, you may consider going for a single new loan. Your mortgage advisor can consult you on the best choice.

5. Last but not least, the emotional side of giving

Being generous and helping your kids is one thing, but what does it do emotionally and in the family bonds? I am no psychologist, but here is my experience: Children may not quite appreciate the offers you have made to get into a financial position that allows you to make those gifts. The hard work, being careful with spending for years. Yes, times were different, but. So do agree with them to sit down at some point for some trips down memory lane, to the extent they have not been there.

I would also suggest asking them to do an annual tribute. Not necessarily to you, but some symbolic way of giving thanks: some work for a charity, cleaning up a creek or a roadside from trash, preparing meals for the homeless, or a nice dinner for all the family? As the gift for the purchase may come in a hurry, when that special house is found, it just helps celebrate a good memory and appreciate that you are fortunate enough to do this.

Anyhow, these are my lessons. All the best with your decision!