Can I get a mortgage with a temporary residence permit?

The short answer is: Yes, it is possible to get approved for a German mortgage as a non-EU citizen living in Germany with a temporary residence permit.Updated on July 15, 2025

However, several limiting factors will affect your maximum loan amount and the number of German banks that you can qualify for.

EU Blue Card holders (BC) can borrow up to 100 % of their house value. In this article, we explain what EU Blue Card holders and other temporary residents can do to obtain permanent residency and potentially get a higher mortgage loan more easily.

We also explain how German banks calculate the so-called loan-to-value ratio (LTV) and how that is used to determine your maximum borrowing amount as a temporary resident. Our intelligent online tool will tell you how much you can afford.

Becoming a permanent resident

If you have been living in Germany, have been employed by a German company for at least three months, are out of your probation period, and make at least about 2.000 € net per month, you fulfill most of the financial requirements to qualify for a German mortgage.

However, German banks will then assess your residency status. Banks' assessment of the risk of non-EU citizens on a temporary residency permit is higher compared to EU citizens. Indeed, there are only a handful of banks that are willing to take such a risk and qualify non-EU citizens for their mortgage products.

One way to increase the number of German banks a temporary resident qualifies for is to apply for a permanent residence permit (“Niederlassungserlaubnis”). Residents who have had a temporary permit for at least five years can directly apply for a permanent residence permit with the “Ausländerbehörde.”

In addition to having your primary residence registered in Germany and having a sustainable income, you will also need to show proof of sufficient German language skills (B1) to get approved for a permanent residency permit.

Several groups can shorten the period before they become eligible for permanent residency:

An EU Blue Card holder may get a permanent residence permit when they have been in Germany for more than 33 months (or, with good German skills, only 21 months).

A non-EU foreigner who graduated from a German university or comparable institution may get a permanent residence permit when they have held a work permit for at least two years after graduation.

If you are married to a German national (i.e., someone with German citizenship) or are a parent to an underage German, you can have a permanent residence permit issued to you when you have been in Germany for three years and are still living with the German spouse or child.

Loan-to-value (LTV) determines your maximum borrowing power

If you are currently a temporary resident and do not want to wait to apply for your permanent residence permit, you can already apply for a mortgage. However, in understanding your maximum affordability (and the size of the down payment needed), the most critical factor dictating how much you can borrow is the so-called loan-to-value (LTV).

The LTV is calculated by each bank and represents the ratio between the loan amount and the property value, which the bank determines according to their criteria. In most cases, the property value will not be the same as the asking or sales price of the property. German banks are quite conservative and risk-averse when it comes to appraising property values and will sometimes value the property 10 to 20% less than the property price.

The higher the LTV, the more you are borrowing and the riskier you are to any bank assessing your status. The maximum LTV EU Blue Card holders can qualify for is 100 % if all relevant factors the banks consider are favorable.

You, therefore, require at least enough equity to cover all additional purchasing costs (notary fees, transfer taxes, etc.).

Example: Let’s say you are interested in a property that costs 400.000 €. We assume that you have the required amount of equity to cover the purchase fees (Berlin: 8 to 11,57 % fees). In addition to covering the purchase fees, you also have enough equity for a 20 % down payment. This means that you would require a mortgage for an amount of 320.000 € to cover 80 % of the property price.

In assessing your mortgage eligibility, a German bank will now calculate the LTV their way. If the bank deducts 10 % from the property price to arrive at a property valuation of 360.000 €, they will calculate the LTV as: A LTV of 89 % is below the LTV cliff of 90 %, which increases the likelihood of getting approved by a German bank.

Do you need assistance understanding what you can borrow? Use Hypofriend's online affordability calculator.

Does the LTV limit affect the interest rate I could qualify for?

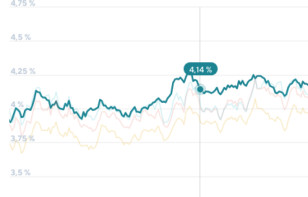

Yes. Among other factors, the LTV determined by each individual German lender will have a direct influence on the interest rate you might end up qualifying for.

In general, the lower your LTV compared to the LTV limit the bank assigns to your residency status, the lower the interest rate. However, this tends to work in steps. In other words, non-EU residents can also expect to qualify for more competitive interest rates, especially if their down payment increases such that the LTV drops 10, 15, or 20 percentage points below the required LTV limits.