Where It Still Makes Sense to Buy a Home in Germany – 2025

For future homebuyers and investors, the question in 2025 isn't if you should buy in Germany, but where. This article examines the findings of the Postbank Property Atlas 2025 to reveal the specific regions where affordability and strong growth potential still align, offering a clear, data-driven overview to consider for potential investments.Updated on 31 July 2025

Table of Contents

Based on the Postbank Property Atlas 2025

📍 These Are Germany’s Smartest Regions to Buy Property Right Now

Despite higher interest rates, buying a home in Germany is far from off the table. 2025 may be the perfect time to invest — if you choose the right region.

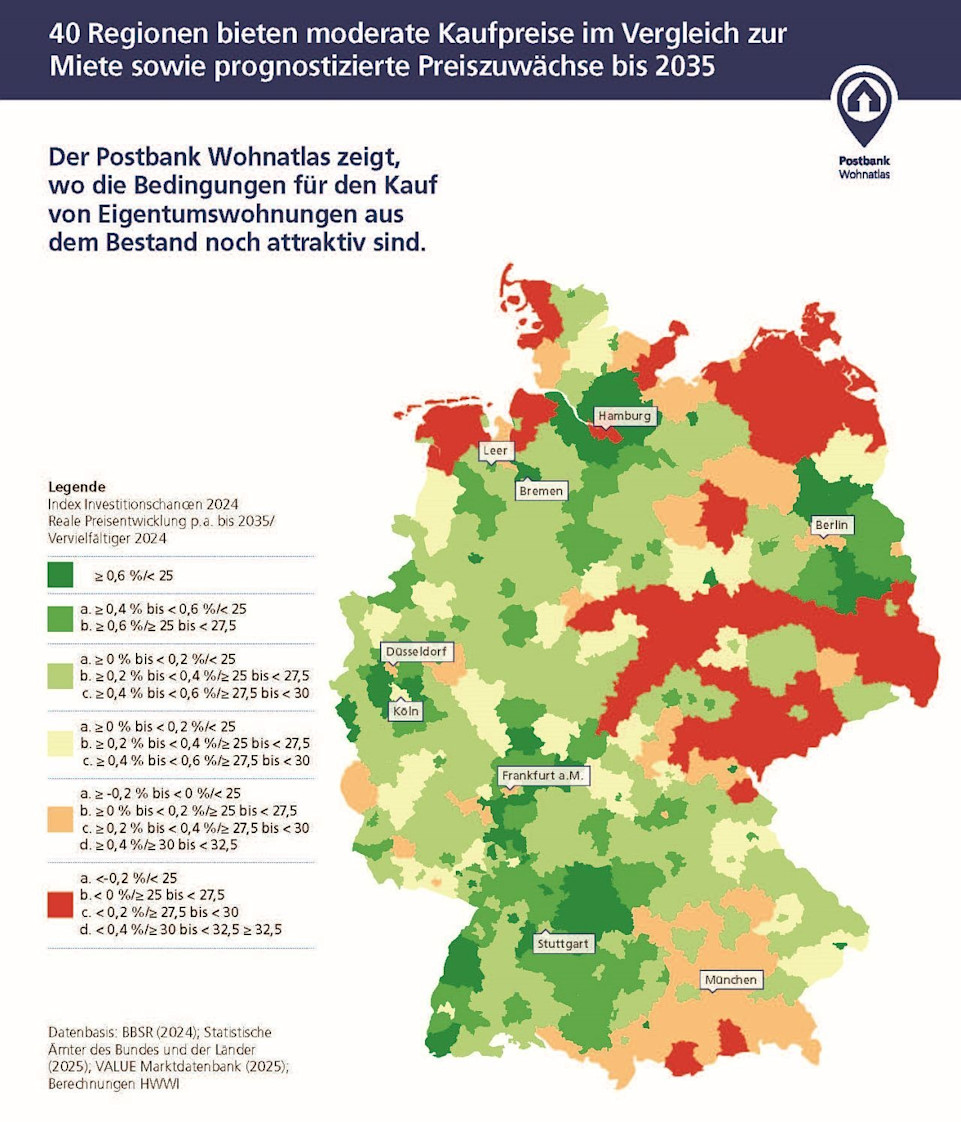

The latest Postbank Property Atlas, developed with the Hamburg Institute of International Economics (HWWI), shows:

🔍 40 regions in Germany still offer the best mix of:

✅ Affordable purchase prices (low price-to-rent ratios)

✅ Expected real price growth until 2035 (inflation-adjusted)

✅ Attractive long-term returns for owners and investors alike

Build your wealth in Germany

Learn how to invest in energy-efficient new builds

Build your wealth in Germany

Learn how to invest in energy-efficient new builds

🧭 What Makes These Regions Stand Out?

The regions marked in dark green on the map combine:

A multiplier (price-to-rent ratio) under 25x

A projected real price increase of ≥ 0.6% per year until 2035

That means you're not just getting in at a fair price — your investment is likely to grow in real value over time.

Build your wealth in Germany

Learn how to invest in energy-efficient new builds

💡 Top Value Regions in 2025

Region | Real Growth (p.a.) | Avg. Price 2024 | Price-to-Rent Ratio |

|---|---|---|---|

Leipzig | +1.9% | €3,231/m² | ~24x |

Barnim (near Berlin) | +1.3% | €2,956/m² | 23.9x |

Dahme-Spreewald | +1.2% | €3,396/m² | 23.3x |

Harburg (near Hamburg) | +1.2% | €3,173/m² | 23.9x |

Worms | +0.8% | — | 20.9x |

Ludwigshafen | +0.9% | — | 21.1x |

💡 These areas combine affordability and future upside — perfect for investors or homebuyers thinking long-term.

Build your wealth in Germany

Learn how to invest in energy-efficient new builds

🏙️ And What About the Big Cities?

Yes, places like Berlin, Hamburg, Munich, Frankfurt, and Cologne remain solid bets — but for different reasons:

City | Outlook | Strategy |

|---|---|---|

Berlin | Prices rising again (+3.1% in 2024) | Long-term appreciation |

Munich | Prices dipped slightly | Premium stability, low yield |

Cologne | Biggest 2024 price rebound (+3.4%) | Entry point for buyers |

Frankfurt | Prices stagnating | Mixed signals |

Hamburg | Price up, low rental yield (2.85%) | Safe but slow |

These cities are less about high yield, more about security and future demand. If you're looking for capital preservation and urban convenience, they still hold value.

Build your wealth in Germany

Learn how to invest in energy-efficient new builds

🚩 Where to Be Cautious

Some regions — especially rural East Germany or structurally weak areas — show no growth or even long-term decline.

⚠️ Factors include:

Shrinking population

Low job creation

Weak infrastructure

A low purchase price alone isn’t enough — always consider demographics and demand.

Build your wealth in Germany

Learn how to invest in energy-efficient new builds

Conclusion: In 2025, It’s Not About Timing — It’s About Location

Germany remains one of Europe’s most stable real estate markets.

But with prices and rates in flux, location quality is more important than ever.

Look for regions where:

Rent and prices are still in balance

Real growth is expected (not just hope)

Demand is driven by population and jobs

Build your wealth in Germany

Learn how to invest in energy-efficient new builds

Want Expert Guidance?

We help expats and investors finance homes in Germany, with access to over 750 banks.

🛠️ Get pre-qualified in minutes

💶 See what you can afford

🧠 Speak with an expert advisor (in English)

Build your wealth in Germany

Learn how to invest in energy-efficient new builds

Sources

Postbank Wohnatlas 2025

HWWI (Hamburg Institute of International Economics)

BBSR, Value AG, Baufi24 (2024–2025 data)