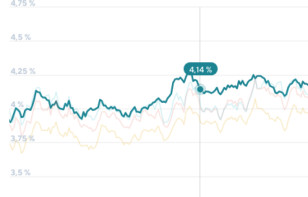

Are houses and apartments overpriced in Germany?

Are houses and apartments overpriced in Germany? What is the actual situation on the real estate market? An analysis.

Dr. Chris Mulder

Published on Jun 11, 2020 . Updated a year ago

At regular intervals, we see news in the German press warning about overpriced houses. Those views are nearly all based on the relative rapid increases of the past five or so years. But frankly, that is misleading. It overlooks what’s happened in the preceding 45 years.