How Real Estate Investors Can Use Depreciation to Maximize Their Tax Refund and Returns in Germany

Depreciation rules were already exceptionally generous in Germany compared to other countries, where depreciation of buildings is rarely possible.Updated on November 14, 2025

The Impact of the Depreciation On Your Income

How does it work? By allowing a portion of the acquisition and building costs to be written off as depreciation, property owners can reduce their taxable income, leading to potentially large savings in their tax bills. Especially for income earners with higher tax rates, this is very attractive.

What makes the approach especially generous is that you can deduct the depreciation from any taxable income you have. In other words, even if the depreciation exceeds the revenue from your investment, you can deduct the depreciation costs from your taxable income.

Basic Example

For a rental property bought for 275.000 €, with land valued at 25.000 €, the 5 % standard depreciation plus the 5 % special depreciation amounts to 10 % of the building value, or 25.000 €. Assuming a taxable income of 100.000 €, this depreciation reduces your taxable income to 75.000 € in the initial year. At this income level, your tax bracket is 42 %, and with solidarity tax 47% (see Annex I), and thus, your overall tax savings amount to 11.750 € (25.000 € * 47 %). This is 4,7 % of the value of the property.

Even with negative operating revenue, say, for example, 2.000 €, these tax advantages transform your property into a profitable venture, yielding 11.750 € — 2.000 € = 9.750 €. With such a high depreciation allowance in the first 4–6 years, you can recover a large part, if not most, of the initial cost of acquiring the property. This reduces your total cash layout and can result in a high rate of return on investment.

Taxable income | 100.000 € |

|---|---|

Purchase value building minus land value | 250.000 € |

Depreciation (5 % + 5%) | 25.000 € |

Marginal tax rate, including solidarity | 47 % |

Tax savings (47 %) | 11.750 € |

Annual operating loss (rent — operating cost — interest) | 2.000 € |

Profit after tax refund | 9.750 € |

Note that over time, the rent will increase, and mortgage interest payments will decline, so your property will eventually return a positive operational income. And when you sell the property, you will benefit from the value appreciation.

Only for rental properties?

Remember that depreciation is only for rental properties or housing used for investment purposes. It is not for housing for own use. The only exception is for monuments, as further detailed below.

No depreciation on land value:

Land cannot be depreciated as it does not deteriorate, and only the value of the buildings can be depreciated.

To determine the amount of depreciation, the purchase price of the property must be reduced with the land value. Tools such as the ones provided by the Federal Ministry of Finance can assist in calculating the land value using the local benchmark land value (“Bodenrichtwert”).

Build your wealth in Germany

Learn how to invest in energy-efficient, commission-free investment properties and save thousands in taxes every year.

See our projectsDepreciation Rates and Periods

How much can you depreciate?

Old buildings constructed before 1925: The annual linear depreciation rate is 2,5 %, spread linearly over 40 years.

Buildings constructed between 1925 and 2022: These can be depreciated at 2 % annually over 50 years.

New building — built from Jan. 1, 2023, onwards: The annual linear depreciation rate has been increased from 2 to 3 %, corresponding to a useful life of approximately 33 years.

New buildings — completed — from October 1, 2023, and September 30, 2029, can also choose accelerated depreciation (§ 7 5(a) EStG): 5 % of the residual value can be depreciated using the degressive method, but you can switch to linear depreciation at any time. 1/

Special depreciation or Sonder AfA (§ 7b EStG) for newly created rental properties that meet the energy efficiency standard EH40/QNG and have an upper construction cost limit of 5.200 € per m². Of this, 4.000 € per m² can be depreciated. You can linearly depreciate 5 % over 4 years. Note: Depreciation applies only after the building has been completed. EH40 stands for Efficiency House 40, and QNG stands for Sustainability Seal. You need to rent out the property (or have it available for rent out) for at least 10 years. It includes newly created apartments through roof extensions, rooftop conversions, or conversion of commercial space to new rental apartments.

1/ Note: Construction of the residential building must begin between October 1, 2023, and September 30, 2029 (a 6-year period). When purchasing a property, the contract must be legally concluded between October 1, 2023, and September 30, 2029. The property must be acquired by the end of the year of completion.

Table: Depreciation (AfA) of Real Estate in Germany

Type of Building | Depreciation Period | Depreciation Rate |

|---|---|---|

Old Buildings before 1925 | 40 years | 2,5 % |

Construction between 1925-2022 | 50 years | 2 % |

New Buildings from Jan. 1, 2023 | 33,33 years | 3 % |

New rental units/houses from Oct. 1, 2023 until Sep. 30, 2029 | Infinite | 5 % degressive. It can be chosen instead of the linear 3 %. You can always switch back to the 3 % linear depreciation. Degressive is typically best for the first 7–12 years. |

New energy-efficient rental units/houses EH40/QNG | First 4 years | 5 % linear, maximum 4.000 €/sqm. This is on top of the above. |

Note: These rates apply to residential rental properties. For monument-protected properties, the standard 2–3 % linear depreciation benefits also apply to owner-occupiers.

The standard 2–3 % depreciation rates apply under the assumption that the rental income of the property is at least two-thirds of the local comparative rent. Otherwise, the depreciation is reduced proportionally.

Example of a newly built EH40/QNG rental unit built at the beginning of the year

Purchase cost (50 m²) | 250.000 € |

|---|---|

Transaction fees (2 % notary; 6,5 % tax) | 21.250 € |

Down payment (Eigenkapital) | 0 € |

Value of the land (including transaction fees) | 50.000 € |

Loan-to-value | 100 % |

Tax and operating cost | |

Degressive depreciation (first 4 years, average) | 9.535 € |

Special depreciation (first 4 years, average) | 10.000 € |

Tax refund of depreciation (marginal tax rate of 40 %, 61,3K taxable income) | 7.607 € |

Rent, net of operating cost | 625 € pm |

Interest (3,4 % blended; 250K loan) | 723 € pm |

Gain | |

Estimated appreciation over 10 years | 54.749 € |

Estimated tax refund over 10 years | 43.143 € |

Estimated operational profit over 10 years | — 34.716 € |

Total gain over 10 years | 63.176 € |

Total gain over 15 years | 102.716 € |

IRR over 10 years with special funding | 18,5 % |

Notes:

These are the results for the first year and the first month of occupation.

We have vetted projects available that reflect this example.

We use fairly conservative assumptions: 2 % value appreciation from the start of the project and 2 % annual rental increase from the completion of the project. One year of building time. One year delay in getting your tax rebate. An estimate of the impact on your tax rate is included.

IRR stands for Internal Rate of Return and is the best measure to calculate compounded annual return on your income.

Linear vs. Degressive Depreciation

The standard depreciation is linear. That means a flat percent is depreciated each year. So if the depreciation is 2 % and the build-up value is 100.000 €, you can depreciate 2.000 € in each of the next 50 years.

Degressive depreciation means that you take the depreciated value as a basis of the depreciation. So in the above example of a building of 100.000 €, if the degressive depreciation rate is 2 %, you write off 2.000 € in the first year. But in the second year, the building value is now only 98.000 €, so your depreciation is just 2 % of 98.000 €, which is 1.960 €.

Degressive depreciation gets continuously smaller and lasts forever. Therefore, it is rarely used for longer periods.

Build your wealth in Germany

Learn how to invest in energy-efficient, commission-free investment properties and save thousands in taxes every year.

See our projectsCan you Depreciate a Depreciated Building?

Yes. And this underscores the generosity of the German AfA. Any building you buy you can depreciate as the purchase cost is taken as the basis for the depreciation.

For example, after you depreciate the building, you could sell it to your partner, and your partner can start the depreciation all over again. If you gift or inherit the building, that is different.

Sonder AfA for Older Rental Properties

The cost of those rental properties built/created based on a building application submitted after August 31, 2018, before January 1, 2022, or a building notification made during this period should not exceed 3.000 € per m² of living space. Only 2.000 € can be depreciated.

The cost of those built/created based on a building application submitted after December 31, 2022, and before January 1, 2027, or a building notification made during this period, do not exceed 4.800 € per m² of living space. Only 2.500 € can be depreciated.

Monuments get special treatment

For monument status-protected properties or Denkmalschutz: These properties can benefit from increased depreciation rates due to higher maintenance costs and stricter restoration criteria. The advantages of depreciation apply even to owners who live on the property themselves.

In addition to the normal 2–2,5 % linear depreciation, the owners can also deduct modernization costs: In the first eight years, a 9 % depreciation can be applied, followed by 7 % in the next four years.

Monument (Modernization) | 8 years | 9 % |

|---|---|---|

Next 4 years | 7 % |

Tax Consultation

The ability to depreciate property provides substantial tax refund to investors by reducing their taxable income, potentially resulting in thousands of euros in tax savings each year. However, it's essential to consult a tax advisor, especially in complex scenarios like renovations and heritage-protected properties, to ensure that the depreciation is maximized legally and effectively.

How to Claim AfA in Tax Returns

To claim AfA on your tax return in Germany, you must include it in the “Einkünfte aus Vermietung und Verpachtung” section of the income tax return. This declaration is critical to ensure that the property owner can benefit from the tax reductions associated with property depreciation.

Conclusion

In conclusion, depreciation serves as a critical tax-saving strategy for real estate investors in Germany. With the recent changes in the law, investors have an even bigger incentive to invest in new properties due to the higher depreciation rates. Understanding and utilizing this aspect of real estate taxation can make a considerable difference in the profitability and sustainability of real estate investments.

Annex I How to Determine Your Marginal Tax Rate

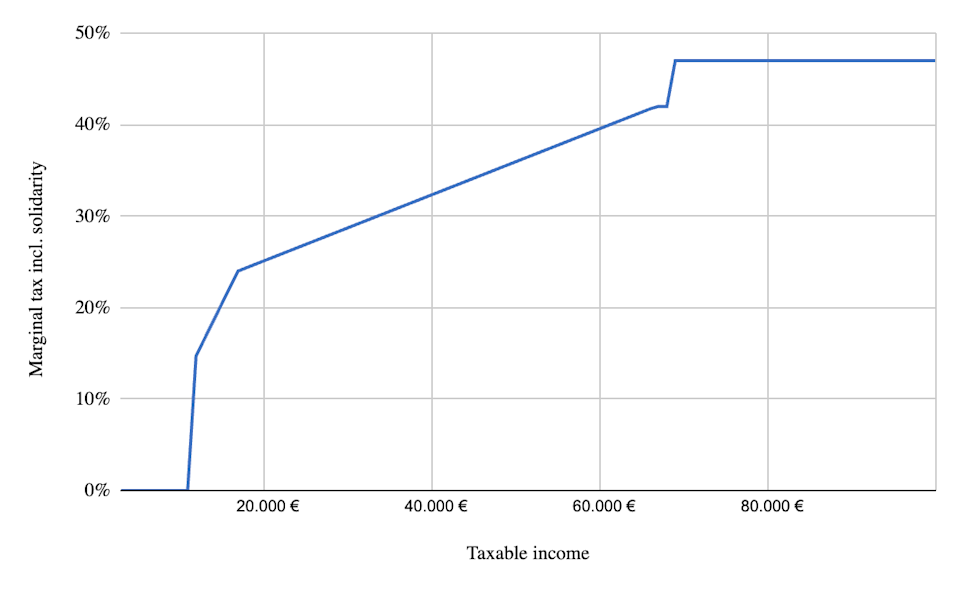

To calculate the impact of a tax deduction on your income, you need to know your marginal tax rate, the tax that you pay on one extra Euro more or one Euro less of income.

The figure below focuses on the income tax rate excluding the solidarity tax for a single filer--Tax class I if you file as a married couple, all the taxable income amounts in the graph double.

You can see the marginal rate for a single filer starts at 0 %, and then at the tax-free threshold of 11.604 €, the rate jumps to 14 % and starts to increase linearly. At first, the increase is steep and then more gradual. Then, at 42 %, the marginal tax rate stays the same until you hit the 45 % bracket.

Marginal income tax rate including solidarity tax (taxable income up to 100.000 €)

In virtually all other countries, the system is more simple, and the graph would look like a stair with a set of steps. For each higher bracket or step, the tax rate is higher.

But in Germany, it is more like a slide with a floor on one hand and two steps at the top. Germany has tax brackets at the beginning (0 %) and at the end (42 and 45 %) but not in the middle.

Impact of the Solidarity Tax

The solidarity tax adds some more complexity, but from the figure below, you can immediately see the overall marginal tax rate and the impact of the solidarity tax.

The solidarity tax is an augmentation of your tax payment. It used to be a flat 5,5 %, so on any Euro in income tax, you would pay 5,5 cents extra.

From 2021 on, the government reduced the solidarity tax to 0 % for those with taxable income below 68.412 €--all those in the under 42 % tax brackets and a few more--while the solidarity tax remained the same for those with taxable income over 105.508 €.

To do this, the government set the marginal solidarity tax rate at 11,9 %, from taxable incomes of 68.412 € on, until 105.508 €. At that point, the tax rate reverts to its old value of 5,5%. As a consequence, the marginal tax rate for people earning in the first part of the 42 % bracket was increased by 11,9 % X 42 % to reach 47 %. Note, 42 % X 1,119 = 46,998 % or 47 % rounded. Over 105.508 €, the marginal rate drops to 42 % X 1,055 = 44,31 %. In the 45 % bracket, your marginal tax rate increases to 45 % * 1,055 = 47,475 %.

Marginal income tax rate, including solidarity tax (taxable income up to 325.000 €)