What Are the Current Mortgage Interest Rates in Germany and How Do They Evolve?

Find the latest and historical mortgage rates in Germany and learn how they relate to bond yields. We help you choose the best fixed rate period with advice tailored to your finances.Updated on November 17, 2025

Current Interest Rates in Germany

What is a fixed mortgage rate?

The fixed interest rate period is the period during which the interest rate on your mortgage does not change. When that period is finished, you must refinance your mortgage: get a new interest rate from your current bank or obtain a new loan from another bank. You run the risk that the interest rate is higher; this is called interest rate risk.

In Germany, you can choose the length of the period that you want to fix your mortgage interest rate.

How do interest rates for different periods compare?

Typically, mortgages with fixed interest rates for 10 years offer the best rate, unlike in other countries, where the 5-year rate is usually better. The reason is that banks try to recoup their fixed costs over a shorter period, so their mark-up over their funding rates is higher.

Variable mortgage rates are even more expensive and basically not used in Germany.

Check what you can afford

Calculate how much you can afford and get a free online mortgage recommendation in only a few clicks.

See what I can affordHow do the banks set the interest rates in Germany?

Banks price most rates compared to the government bond yields, especially the 10-year rate because this is the alternative in which they can invest without risk. In addition, the more money you bring, the lower your loan-to-house value ratio, the lower the bank risk, and the lower the rate you have to pay for your loan.

All mortgage rates follow the 10-year rate closely because clients can always refinance their mortgage for free after 10 years. That means that the banks need to charge the 10-year rate at least. The longer-term rates, like the 15 and 20-year rates, are therefore virtually always higher than the 10-year mortgage rate.

How do I pick the best fixed period for me?

This is your most important mortgage decision and, possibly, your most important financial decision.

Usually, 10-year mortgage rates are cheaper than the other rates, but they expose you to more risk. You, therefore, need to review if you can carry this risk, given your income outlook and the way you will repay your mortgage. Your Hypofriend advisor can do that for you and examine if it is worth your while to fix your rate for longer, given how long you plan to stay or hold on to the property.

What is the Hypofriend approach?

Our approach is to help you find not just the best rates in Germany, but also check if you can handle the risk of changing interest rates and if it is worth your while. To that end, we ask you the key questions, such as how long you want to stay and your estimated income growth. We combine that with our interest rate predictions to show you if you can take the risk, if banks accept the risk, and what would your best choices.

As input, we use best-in-class models to forecast the interest rates and the scope for interest rate changes. This approach is quite unique.

Where can I find your interest rate outlook?

In our mortgage calculator, we use both our baseline prediction and alternative interest rate scenarios. In our consultations, we share our outlook and recommendations.

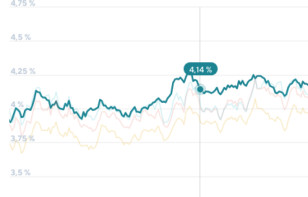

In the figure above, you see the latest government bond rates. The mortgage rates you see are historic. They tend to lag a bit with the actual offers, as it takes several weeks before mortgages are final and reported. They are also not the best offers available, as they include people with lower down payments or other risk factors.

Can you predict interest rates?

Predicting rates is very hard, meaning there is a lot of inaccuracy in the predictions. But using the best models yields much better results than just using your gut as an outside observer.

The best-in-class models are based on the revealed preferences of the bond market participants, which include large actors like pension funds and hedge funds. We do check if the markets are in line with underlying economic fundamentals. When we provide a concrete mortgage offer, we anticipate bank short-term interest changes and monitor if we should ask banks to adjust their offers down.

How should I proceed for more advice?

Please sign up here. We help you first to determine how much you can afford so you can search effectively using, for example, our property radar tool. You can schedule a free appointment, and we will discuss all relevant German mortgage issues tailored to your situation.