Commitment fee: How much to pay if your new build isn’t ready?

With a new build project, you have a tough schedule. That's necessary if you want to avoid paying commitment fees to your bank.Updated on July 15, 2025

The situation is different if you are building a house or you buying a new-build property. In this case, you do not need the entire loan amount at once, but in partial amounts when construction phases are completed. If the construction is delayed, your costs at the bank will increase. The reason is commitment fees. What's behind it, and how do you prevent it?

Commitment fees instead of mortgage interest

When banks commit to lending you money, they cannot use it for another purpose. This is why you're paying interest on your mortgage – that's the deal. The interest-only becomes due once the bank has paid out the loan.

This is with a new build, not all at once. If the mortgage contract has been signed, the bank cannot use your promised money for any other purpose. However, the bank will not receive any interest from you until the loan is fully disbursed. Therefore, they charge a fee.

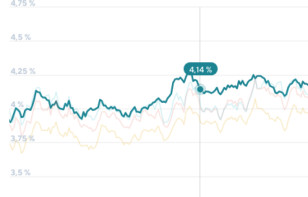

These so-called commitment fees are normally lower than the interest rates on the mortgage itself, but nowadays, most banks charge 1.5 to 3 percent in fees and, hence, more than the rate on the actual mortgage!

The good thing is that banks, fortunately, offer a commitment fee-free period. Usually, the commitment fee-free period is between six and twelve months. Some banks also do not charge for 18 months, and only some banks offer 24 months free of charge.

Have an eye on the commitment fee-free period

Depending on how long your construction project is to last, the length of the commitment fee-free period is an important factor to consider when choosing a mortgage. Otherwise, you will have to expect additional costs.

In this example, Bank A) offers a ten-month commitment fee-free period. Bank B) offers only three months. After that, both banks charge a fee of 0.25 percent of the loan amount per month. You expect to need the money in eight months.

With bank A) there are no further fees for you. With bank B) you will have to pay 4,375 euro commitment fees. They offer you only three months out of charge, but you need five more. Five times 0.25 percent results in 1.25 percent of the loan sum as additional fees.

The main facts you want to know about the commitment fee

The commitment fee is paid on money that has not yet been disbursed.

Interest is paid on all the money disbursed.

You first have to use your own money – as committed to the bank – before the bank disburses its loan.

You don't need to repay any principal until the loan is fully disbursed.

Calculate commitment fees

Hypofriend can calculate exactly how many fees and interest you have to pay. Thus, we can easily compare different offers from banks and find the ideal one for you.

The calculation also helps you to plan better during the construction phase because you know what expenses you will have to pay, and you can save money if necessary. In the worst case, you could end up paying rent, interest, and commitment fees.

For this reason, it is worthwhile to have a precise schedule when building a house and to try to keep on time as much as possible.