Mortgage for Blue Card Holders: Should You Buy Now or Later?

We explain what options you have as a Blue Card holder to expedite your home purchase, and when it makes sense to wait.Updated on November 17, 2025

Here Are Your Five Key Facts

Maximum affordability: As a Blue Card Holder, you can get a loan of up to about 100 times your net monthly income.

Mortgage eligibility: A Blue Card Holder is eligible for a mortgage, but to get a well-priced loan with reasonable repayment rates. It would be best if you had enough equity to cover the purchase costs to keep your loan-to-value ratio (LTV) at 100 % or less.

Benefits of a permanent residence permit (PR): The main benefit is that it reduces the amount of savings you need before you buy a house. It also increases the house you can afford – but rarely more than 10 %.

PR eligibility:Blue Card holders are eligible for a PR after 33 months if they can prove “basic” German knowledge (level A1) and after 21 months if they have more “adequate” knowledge of German (level B1).

Credit loan eligibility:A Blue Card holder can get a credit loan to boost their savings, which can be used as a down payment for a house, but it has to be repaid before the Blue Card expires. In other words, if you borrow 30 % of your salary and have left 3 years on your BC permit, you have to repay 10 % of your salary per year.

How Can You Maximize the House You Can Afford in Germany As a Blue Card Holder?

A lack of savings is the usual critical limitation of Blue Card holders who want to buy a house in Germany. You usually need to bring at least the purchase fees. That may not be what you want: when house prices increase, you may have to pay a lot more for the same house once you have saved enough.

The good news is that we have options to augment those savings.

You can take out a credit loan that counts as a down payment, and you can thus buy sooner, saving on rent and benefiting from rising house prices.

Here, you can find more information on how you can increase what you can borrow.

The bad news is that you have to repay this loan very quickly. The table above shows how much you need to devote to paying off the credit loan and mortgage to afford your maximum home as a Blue Card holder.

Is It Better to Wait to Get Your Permanent Residence Permit (PR) Before Buying a Home in Germany?

If you have limited savings and are close to the end of your BC, it makes sense to get your PR first. It then makes more sense to wait and buy a house that is more valuable (and thus appreciates over time more) and that fits your size needs – moving house in Germany is costly due to the high additional purchase fees.

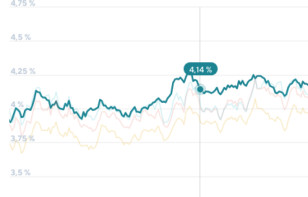

Also, if your German language skills are okay, get your PR as soon as you can, especially if your savings are modest. Moreover, more banks will be available for you as PR and interest rates will be a bit more attractive. But we are typically talking about 0,1 to 0,3 %, so the rate impact is not massive.

If your income is growing rapidly and house prices are not, then you can afford to wait. But with house prices increasing at a solid pace (4 to 6 %), the best strategy for most BC's in Germany is to determine the size and price of the house you need and then see what is the earliest you could afford this house – using the credit loan option discussed above.

Consider that, conservatively, you lose about 40 % of your annual income for each year that you rent and do not buy (your maximum house). That is when house prices increase at the long-run trend of 3 to 4 % annually.

So waiting only makes sense (for most BC's) if you cannot buy the house that is right for you.

Why Buying a Car Is a Bad Idea

We regularly come across BC's and other TRs (temporary residents) that have bought themselves a nice new car, and quite often with a loan. Please don't do that before you have checked your housing options!

When you buy a new car and drive it out of the showroom, it has already lost 10 to 20 % of its value. And roughly every three years, the value halves. But what is worse is that that car eats up either your savings or reduces your ability to augment savings with a credit loan. Each euro spent can reduce your ability to buy a house by six to 15 euros!

That new car limits your ability to climb the property ladder. Be wise, be patient. Buy an older car or stick to some short-term rental program. That nice car can come later.

What About PR/BC Couples?

Unfortunately, we do not have very good news. It is usually the lowest common denominator that matters for the bank. So, the same advice that applies to BC singles and couples – detailed above – applies to you. Save or apply for a PR as fast as you can.

What About Other Temporary Residents (TR)?

The main differences are that, as another TR, your early eligibility to get a PR is not as good and that fewer banks will work with you. But in essence, otherwise, the same solutions exist.