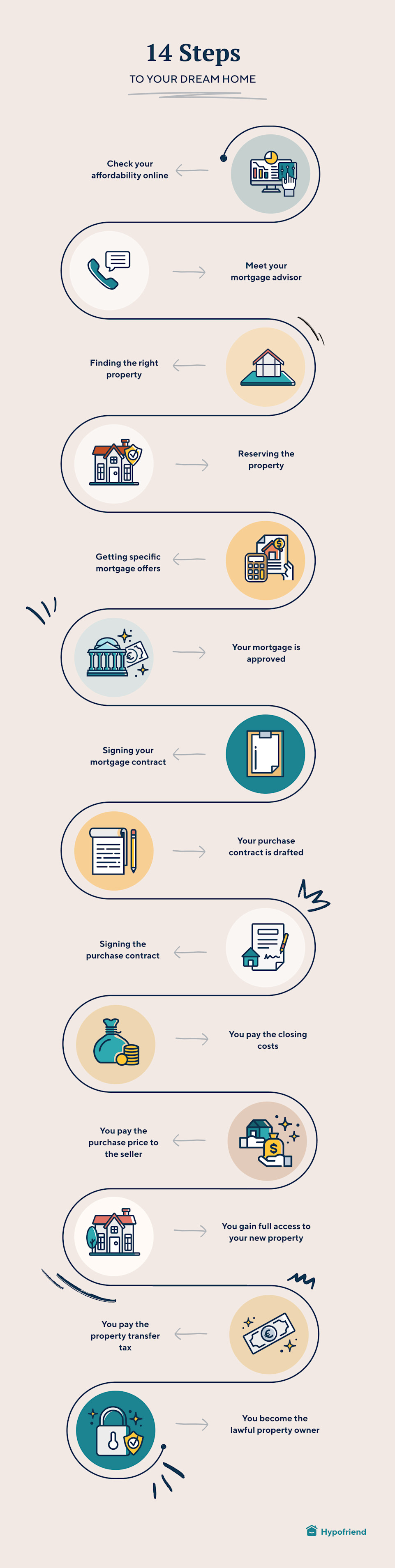

Step-by-step guide: How to buy property in Germany

The process of buying property in Germany explained in full detail. Beginning with the search all the way to becoming the legal owner.Updated on July 15, 2025

- Step 1: Check your affordability online

- Step 2: Meet your mortgage advisor

- Step 3: Finding the right property

- Step 4: Reserving the property

- Step 5: Getting specific mortgage offers

- Step 6: Your mortgage is approved

- Step 7: Signing your mortgage contract

- Step 8: Your purchase contract is drafted

- Step 9: Signing the purchase contract

- Step 10: You need to pay the closing costs

- Step 11: You pay the purchase price to the seller

- Step 12: You gain full access to your new property

- Step 13: You pay the property transfer tax

- Step 14: You become the lawful property owner

If you are an expat who is looking to buy in Germany, you are poised to experience a property buying process where you will be exposed to many unfamiliar German terms and processes different from buying property in your home country.

To help you along the way and demystify the process, this guide is designed to outline all the steps clearly you will go through when buying a property in Germany.

Please note: The buying process outlined in this article is mostly applicable to the process where you buy an already existing German property. If you are looking to buy a new built property from a project developer, the buying process will differ slightly, but is fundamentally very similar.

Step 1: Check your affordability online

Before you start your property search, it is critical that you understand whether it makes sense to buy (and how much) and how high the loan is that you could qualify for.

You can use Hypofriend's comprehensive rent-or-buy-calculator to check whether it makes sense to buy and our affordability calculator to give you an estimate of what the bank will be willing to lend to you given your financial and personal situation (employment etc.).

Knowing your affordability will give you the necessary information to understand what realistic range of property prices you could be looking at.

Step 2: Meet your mortgage advisor

After you have calculated your maximum affordability, you should get in touch with one of our independent mortgage advisors, if you have an unusual situation or want to stretch your affordability. For example, if your employment status is less usual (such as being self-employed), your residency status is unusual (your partner may have a temporary residency), or if you may need a credit loan to reach your desired level of affordability.

Keep in mind that a phone or video call is quickly made, and it helps to be educated in this financially so important aspect of your life. A Hypofriend advisor can answer your questions in a free video or phone consultation.

Step 3: Finding the right property

Your affordability will dictate the (maximum) property price range you should be looking at.

There are many ways of identifying the right property given your personal and financial circumstances. Especially if you are stretching your affordability, you may want to test if you qualify through a pre-approval on a specific property, and thereby solidify your ability to make hard offers and compete with other buyers.

By the way: If your dream home stretches your financial possibilities, you can increase your chances and set yourself apart from the competition with a financing certificate. A financing certificate is usually property-dependent, but non-binding. It is issued after a preliminary and non-binding assessment of your financial situation by your financial advisor.

When searching for properties, always bear in mind that purchasing costs will be incurred in addition to the purchase price. Use our purchasing costs calculator to determine these costs and include them in your planning.

Step 4: Reserving the property

When buying through a real estate broker, the most common method of securing that property is to sign an official reservation.

After you have viewed the property, the seller/real estate broker will send you a reservation form. To reserve a property, you will typically need to pay a reservation fee (0,5 to 1 % of the property price). In some rare cases, reservations can be free of cost. Only after the reservation fee has been paid, will the property be reserved in your name and be taken off the market.

The reservation period usually varies between 2 and 4 weeks, and that should give you enough time to finalize your mortgage. If you go ahead with the property purchase, the reservation fee will be deducted from the broker commission or the property price.

If you decide not to purchase a property that you have reserved and paid a fee for, the reservation fee is either to be paid back partially or not paid back at all. Therefore, if you reserve a property, you should be very certain that you will also go ahead with the purchase.

Step 5: Getting specific mortgage offers

Before paying the reservation fee, we strongly recommend checking back in with your mortgage broker and obtaining a valuation estimate of the property you wish you reserve, to confirm if the price is reasonable. Also, banks may apply a discount to the valuation of a specific property, and you need to know that discount.

At that point, you also need to be quite sure, if you qualify for a mortgage, and understand the choice of mortgage product, and the interest and repayment conditions that you will be facing. A 30 to 60 min consultation with your Hypofriend advisor is typically enough to give you a good grounding in these topics and help you preselect what is the right mortgage product for you, or narrow the options to an understandable range.

You should also start sharing the basic documents. This helps to get approval quickly for your mortgage and avoid nasty surprises.

After reserving the property, you will have several weeks to finalize your mortgage offer. Upon reservation, you should receive or get access to all the necessary property documents from the seller. In addition to your personal documents, the property documents are essential to complete your mortgage application.

Following your decision on the best mortgage product, your mortgage advisor will bring together all personal and property documents and submit the entire mortgage application to the most suitable mortgage lender.

Step 6: Your mortgage is approved

After your mortgage application has been submitted, it will usually take a bank 3 to 10 working days to process your application.

Some banks may ask for additional information to clarify questions related to your employment status, residency status, income, etc. Some banks may in some cases have your property value appraised by an external expert, rather than relying on automated systems to assess the value.

After all remaining questions have been clarified, the bank will let your mortgage advisor know about the final mortgage approval.

Step 7: Signing your mortgage contract

After receiving the mortgage approval, you will typically have up to 2 weeks to sign that contract (your mortgage conditions will not be subject to change during that period).

It is important to note that there is no financial or legal obligation if you decide not to sign a mortgage contract that has been approved by the bank. The bank will not charge you any penalty fee for not signing the contract. This gives you flexibility in case something does not go as planned.

Step 8: Your purchase contract is drafted

After you have reserved the property (and signed the mortgage contract) a public notary that either you or the seller are free to select will create the first draft of the purchase contract.

It should be noted that from the day that you receive the first draft, there is a mandatory 14-day waiting period before the final contract can be signed at the notary's office.

Here you can read more about the notary procedure in Germany.

Step 9: Signing the purchase contract

On the day that you sign the purchase contract, you should count on personally visiting the notary office – representation by someone else is a tedious process.

The notary will read out loud the entire purchase contract – this is required by law. You are allowed to ask questions in between and potentially propose last-minute edits to the contract. The notary procedure usually takes 1 hour.

Important note: The notary will arrange for you to be reserved as the future owner of the property in what is known as a priority notice. This notice is made to the land registry (“Grundbuch”). This notice implies that you have been reserved as the only buyer and protects your right to have the title of ownership transferred to your name 8 to 16 weeks later.

Important note: From the date that you sign the purchase contract, you also become liable for all rights and obligations that come with owning property, e.g., maintenance fee, property tax, etc.

Step 10: You need to pay the closing costs

After your property purchase has been fully notarized, the next step will require you to pay for the additional purchase costs (first from your equity if that is adequate).

If you bought your place through a real estate broker, a few days after signing the purchase contract, you can expect to receive an invoice from that broker. Several weeks after the purchase has been signed, you will also need to pay for the notary's service. Another closing cost is the property transfer tax (“Grunderwerbssteuer”, Berlin: 6 % property transfer tax) – to be paid later, see step 13.

In some cases, you will also need to pay a small amount (about 100 €) to the property manager because their approval for the property purchase might be needed.

Step 11: You pay the purchase price to the seller

Six to eight weeks after signing the purchase contract, the notary will ask you to pay the full purchase price to the seller.

This means that you will have to pay part of the purchase price from your equity, i.e., this is your down payment. The remaining amount (your loan amount) will need to be transferred directly from your mortgage lender to the seller's bank account.

To approve that payment, you will need to fill out a purchase order form that authorizes your lender to make that payment.

Step 12: You gain full access to your new property

Only after the seller has received the full amount of the purchase price in their bank account, can you arrange for the official handover of your new property.

In case of a vacant property, you will arrange for a key handover either with the real estate broker or the seller directly. In the case of you buying a rented property, you might arrange to meet the tenants or inspect the property in more detail.

Important note: Even though at this stage you have gained full access to your new property, it still does not mean that you are the lawful owner of that property. You only become the lawful owner after you have been entered into the German land registry (“Grundbuch”). This process can take quite long and usually takes anywhere between 8 and 16 weeks after signing the purchase contract at the notary.

Step 13: You pay the property transfer tax

Six to ten weeks after signing the purchase contract, you will receive a letter from the tax office asking you to pay the tax amount.

The tax office will then notify the notary office that this tax has been paid, and a so-called clearance certificate will be issued to the notary. The notary will then instruct the land registry to change the property's ownership title to your name.

Step 14: You become the lawful property owner

Only after you have paid the land register fee (about 0,5 % of the purchase price) to the German land registry, will the ownership title be officially transferred to your name.

You are now the legal property owner. Congratulations!

Here is an overview of all 14 steps:

Interested in reading about Rhianon and Oliver's experience buying a property in Germany? Check out their interview.