How a "Bausparvertrag" can help you avoid high interest rates for refinancing

Worried about the future interest rate on your mortgage? We have some solutions that can minimize your interest rate risk!Updated on May 19, 2025

The key points

Does a Bausparvertrag make sense for you?

In Germany, you have a special instrument to reduce the risk that your interest rate will jump in the future, which is called a Bausparvertrag or BSV. This is for homeowners who already have a mortgage. Using a BSV to purchase a home is a very different issue; we have a separate article on that.

This BSV instrument for protecting you against interest hikes has become rather attractive.

A BSV allows you to lock in a relatively low future interest rate. Indeed, borrowing at 1,25 % or 1,5 %, 6–10 years down the road, can be very attractive in light of current high mortgage rates. It almost sounds too good to be true.

Therefore, we have created a tool that allows us to evaluate precisely if and how it makes sense.

How does a Bausparvertrag work to reduce interest risk

You can use the Bausparvertrag (BSV) to save until the end of the fixed interest period on your mortgage. Then, when the time of the interest reset arrives, the Bauspar company grants you a loan at a low fixed interest rate until you have paid off that loan. That loan is typically 1 to 1 ½ times larger than the amount you saved up. This means you reduce your mortgage by your savings in the build-up phase (“Ansparphase” in German) and by the repayments in the payments phase.

Whether this is really attractive depends on how quickly you need to repay the loan part of the BSV. If that loan part is very rapid, then you do not benefit much from the low fixed interest rate. We have therefore focussed on finding you a product with a long repayment period.

You do need to be aware that the money in your savings account pays you very little interest. In addition, you have to pay a fee of about 1,5 % for the product.

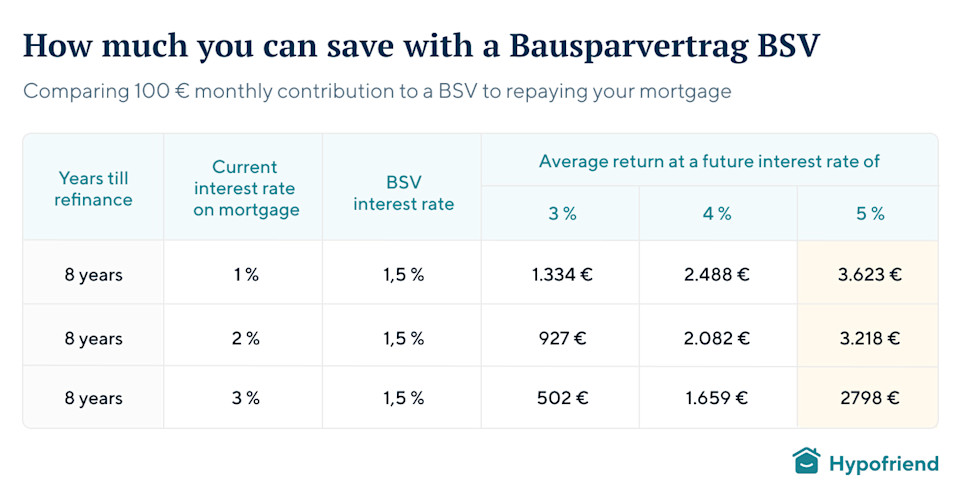

In the table below, you see at what expected interest rate it makes sense to conduct a Bausparvertrag and how much you would stand to gain for every 100 € per month you pay into such a product if the future interest rate is 3%, respectively 4 % and 5 %.

For each 100 €, you would save up about 9.000 € until the end of the fixed interest period and then, in total, reduce your mortgage interest risk by 20.000 €, by having a low interest rate loan for the next 9 years, which you repay at about 100 € per month.

Overall, we calculate that with current interest rates on mortgages of about 3-4 % for refinancing with a good loan-to-value ratio, your return on investment of a BSV is about 2-4%. This is rather attractive compared to putting your money in the bank.

If you want to discuss how much is advisable for you and what product is best, our brokers have access to a special Hypofriend-built tool to evaluate your alternatives.

Keep in mind that a key benefit is the flexibility of the product for this purpose. You can decide on the amount you are willing to save, and even during the build-up phase, you have the flexibility to add to the savings or pay in less.

For many people, it makes sense to target at least a specific amount, like the repayment for their KFW loan, or have a round number in mind to help keep you on track with your savings and expenditure planning.

An even better alternative is a private pension plan.

It may not sound intuitive at first sight, but paying into a private pension plan (PPP) is also a great option and, in quite a few cases, even better. You can use a PPP to invest in a tax-efficient way in ETFs, and then use the build-up sum to reduce your mortgage balance if the interest rate on the mortgage is high. Otherwise, just let it run, and then you use the proceeds for your pension or, for example, to buy a second home.

With a private pension plan from Pensionfriend, you also have flexibility as you don't pay any up-front fees. You can augment or reduce your contributions without cost, and likewise take out your money anytime without cost.

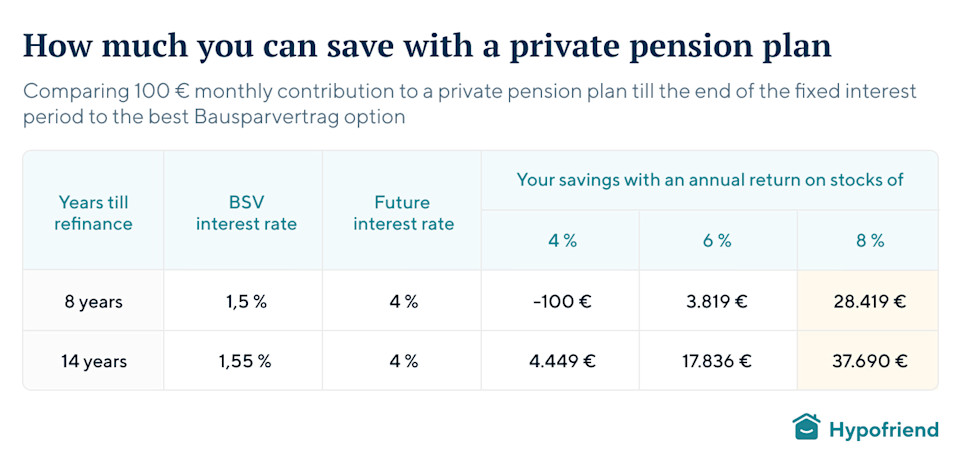

Especially when interest rates turn out to be low, and you have a long period until the end of the fixed interest period, a private pension plan is by far the most attractive alternative. In Table 2, we show you the outcomes for different possible scenarios. You can see that, especially with a long fixed interest rate period (and hence a long period of, for example, 14 years until your refinancing need), the PPP is very attractive, and also if annual returns are high. In the outcome, we assume that the cost of a Pensionfriend Pension Plan is deducted.

Don’t save your questions. We’ve got answers.

Can I pay less into my BSV when it does not suit me? What happens then?

Yes, with a Bausparvertrag, you are flexible in the savings phase. You can make fewer payments or stop paying. Your Bauspar loan will then be less. If you save more, it will not help unless you choose a total contract that has some space for higher payments. The provider of the Bauspar contract will examine if you made your average payments on time to determine if you are eligible for the full amount of the loan in the contract.

Please be aware that if you reach the savings target later, or if you will do not reach your target, you cannot get the same loan amount (or you get it later). If you still want the same loan amount, the Bauspar societies are offering you the option to take a bridge loan from the end of the refinancing to the payout.

Does this mean a BSV is a good idea if I buy a new property?

Not necessarily. A BSV for a refinancing does not force you to stick to a high repayment plan. However, a BSV that you use to finance a new property fully requires you to save the necessary amount in time; otherwise, your refinancing loan is jeopardized. A BSV for a new property is also differently priced, as you need a much longer savings phase to keep your payments at a reasonable level. Likewise, the repayment phase is much longer. Therefore, interest rates are much higher.

The product we have summarized in the main article is especially attractive.

We have recommended that clients in the past include such an extra BSV when purchasing a home when the 10-year fixed rate mortgage was their preference as a way to at least partially ensure a low rate after 10 years. You can still do this if you, for example, expect your income to grow, or you expect bonuses that you could save through a BSV.

What about alternatives like a Forward Darlehen?

A Forward Darlehen locks in the future rate at the current interest rate plus a fee. It is a good option when the fixation period ends in the next 3 years (a few banks also offer up to 5 years earlier). With this Forward Darlehen, you can fix the interest rate already today for the remaining loan balance at the end of fixation. So, if you expect higher interest rates than we have today, you can secure yourself against that risk of a higher rate. Please be aware that the interest rate is slightly higher than the current offers. This surcharge is usually around 0,01 %-0,02 % per month on top of the current interest rate. So if your fixation period, for example, ends in 12 months, your interest rate is 0,24 % higher.