Rent or Buy in 2026? Does Buying Still Make Sense?

Property prices in Germany are trending up again around their long-term average and 2026–2027 forecasts are converging.Updated on January 6, 2026

We see house prices going up in line with the long-term trend.

The very long-term trend is 3%, but we are now seeing increases closer to 4%.

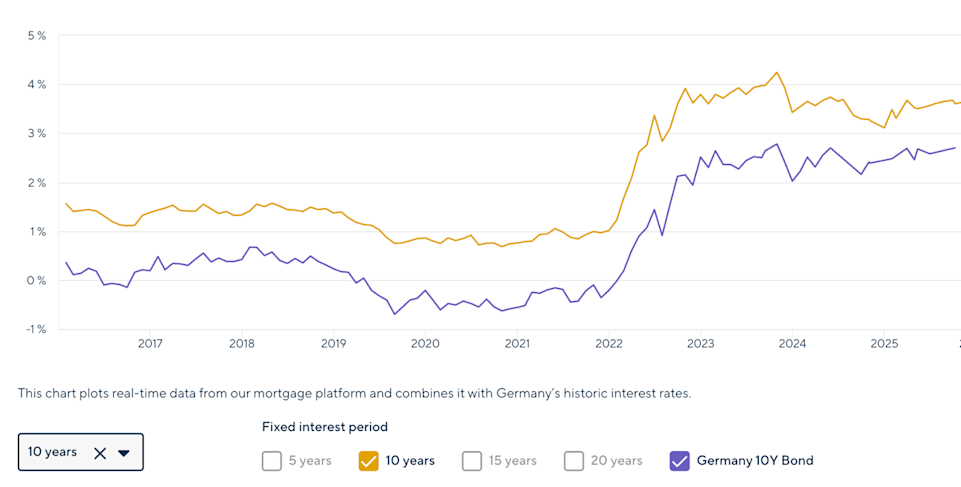

Interest rates have been on a very gradual uptrend this year in Europe.

Mortgage rates are now close to 4%.

The underlying reason for the modest uptrend is fear of higher government deficits, driven by plans for a military buildup (higher NATO norms), infrastructure investments, and political inertia.

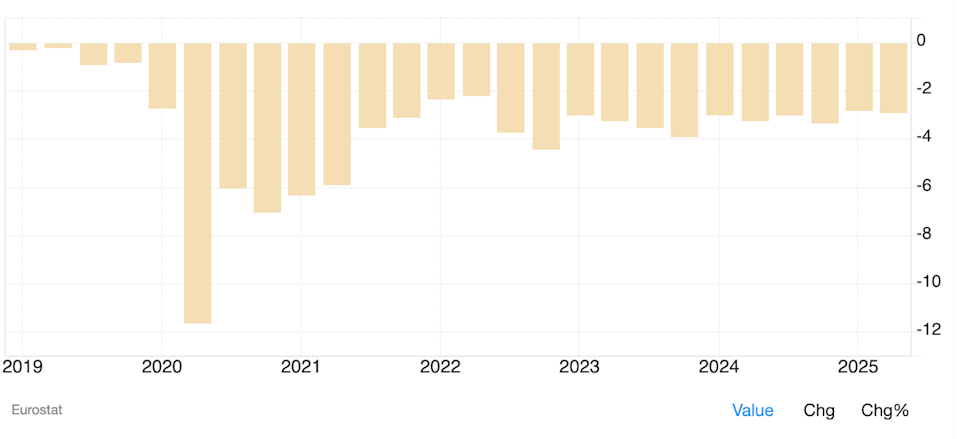

While the fears are there, the data doesn’t show much of an increase yet, rather a structural uptick post-Corona to deficits that are close to the limit of 3%.

EU Fiscal Deficit as % of National Income

What Does it Mean for Your Decision to Buy or Rent?

In line with the above, the latest research points to modest, steady growth:

The basic rule of thumb is that the:

Cost of buying = mortgage rates (4 %) + maintenance (0,5-1 %)

Should be less than:

Benefit of buying = current rental rate (3 %) + appreciation (3-4 %)

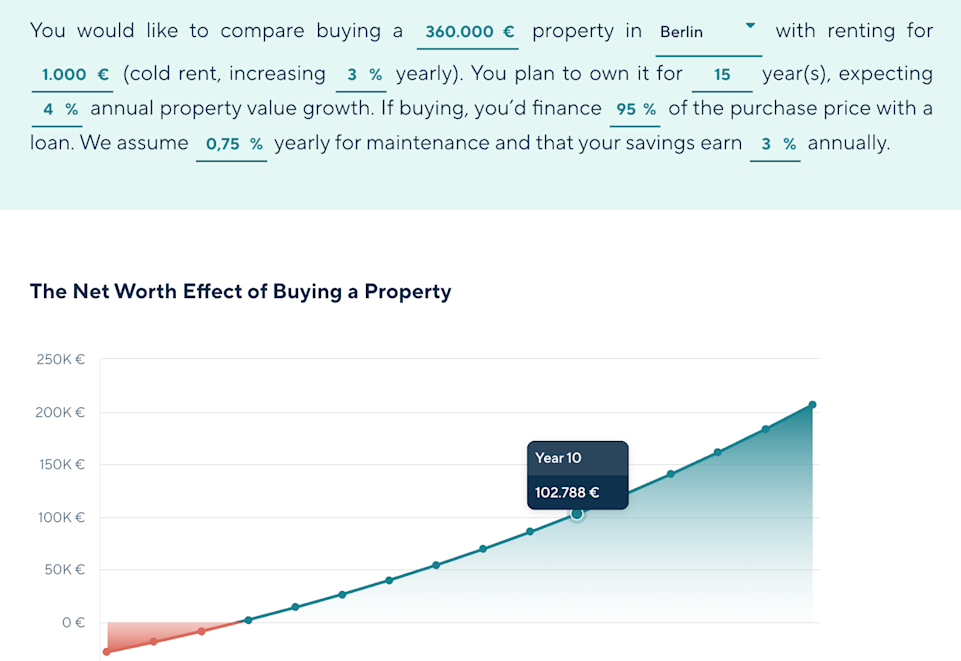

The cost of buying at 4-5 % is much smaller than the benefit of buying at 6-7 %, so a quick evaluation suggests it still makes sense to buy for the long term.

Most people would stand to gain 15-30 % of the purchase price in 10 years and about double that in 15 years.

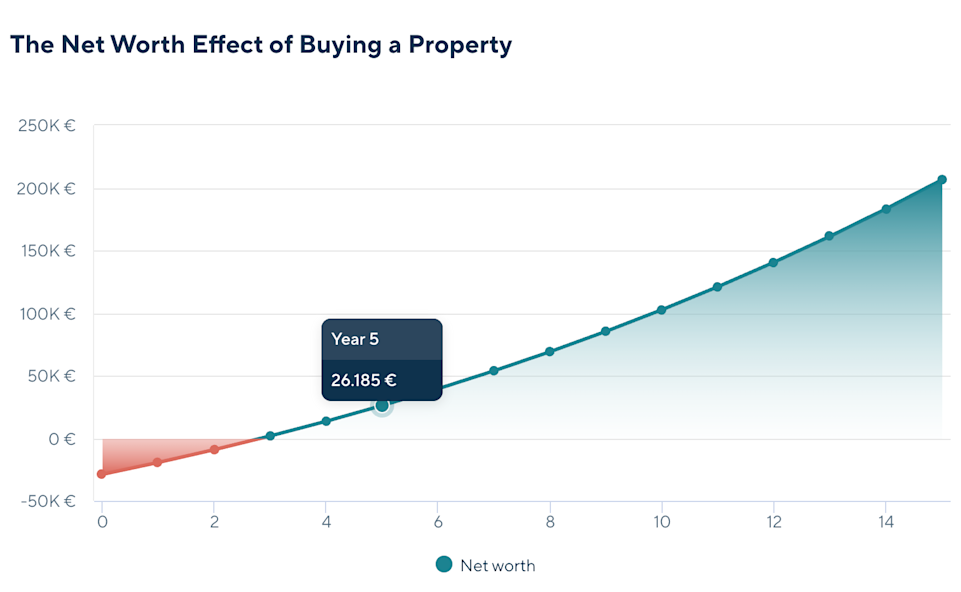

Of course, practice is more complex as the figure shows. You have fixed purchase costs, so you start in the red. Over time, your mortgage balance decreases as you pay it off, while your rent increases; therefore, the line curves up and becomes steeper as years pass.

Check what you can afford

Calculate how much you can afford and get a free online mortgage recommendation in only a few clicks.

See what I can affordWhat About All the Turmoil? What Does it Mean for Your Decision to Buy or Rent?

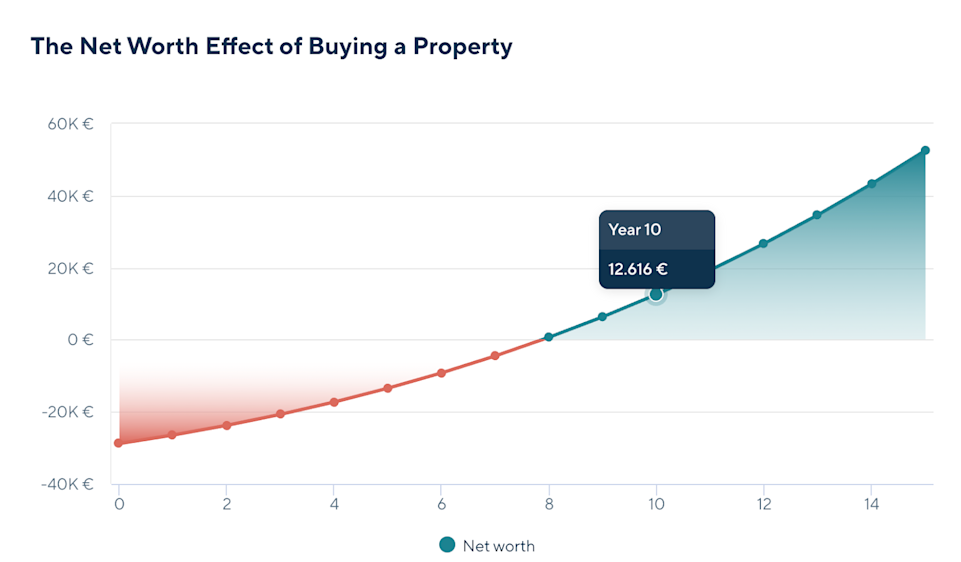

First, let us consider the biggest risk: a slower increase in house prices. If prices increase by 2%, or half the current trend, does it still make financial sense to buy?

Your gain is much smaller, but still is positive in 10 years, and reaches about 15% of the purchase price in 15 years' time.

Second, let us consider that you need to move to another town in 5 years or leave Germany.

Clearly, the best option is to rent out the property after 5 years and let your profits run, but even if you sell in 5 years, you will still break even on your purchase.

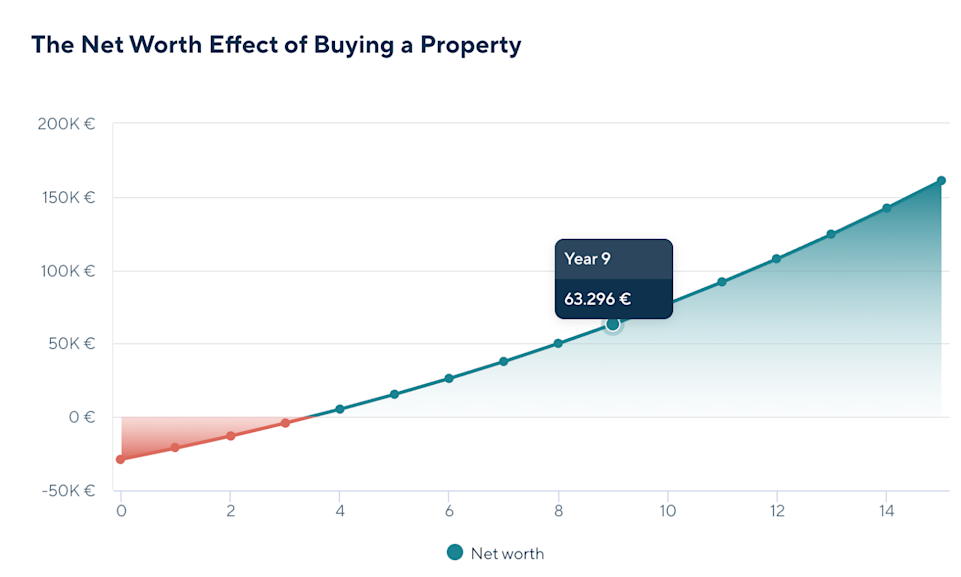

Third, what about delaying? Let us consider that you postpone your decision by a year.

Most likely, interest rates are a bit higher, but most importantly, your delay limits your most profitable years by one: the year when, due to compounding, the price increase is the most.

The figure below shows your gain to be about 63.296 € after 9 years of ownership, or 10 years from now, compared with 102.788 € in the baseline shown above. Half of this could be due to higher rates.

Conclusion

Homeownership can make a meaningful change in your life, choosing a place that fits you, where you feel you belong.

But it can also be a very scary decision, especially now that we see changes in the world that were not seen as possible just a few years ago.

Taking a hard look at the numbers may help you make a decision. We did it above for the general situation. Speak with one of our mortgage advisors to discuss your situation in detail.

We can also consult you on alternatives as well. Sound ETF investment and attractive high-yield rental properties. We are here to help you build a safe and sound financial future.