Property Depreciation Calculator Germany

Fill in your details

Your Results

As your property was completed in 2024, it is eligible for 5 % degressive depreciation. This means:

Depreciation amount 23.000 € | Estimated Marginal Tax Rate 43,44 % | Tax Refund on Depreciation 9.991 € |

Over the next 10 years, the depreciation benefit earns you about 50.624 € in tax repayments. This adds 20,25 % to your net return, or 3,41 % by year.

After 10 years, you have 59,5 % left to depreciate, which could earn you 46.575 € more in tax rebates.

What Determines the Size of your Depreciation Benefit?

Your tax reduction formula is calculated as:

Total Depreciation x Your Marginal Tax Rate = Tax Saved

Total Depreciation Amount: This is the sum of all annual depreciation allowances that reduce your taxable rental income. This is especially powerful in Germany, because losses from real estate can be deducted from any income category. The details are discussed in the next section.

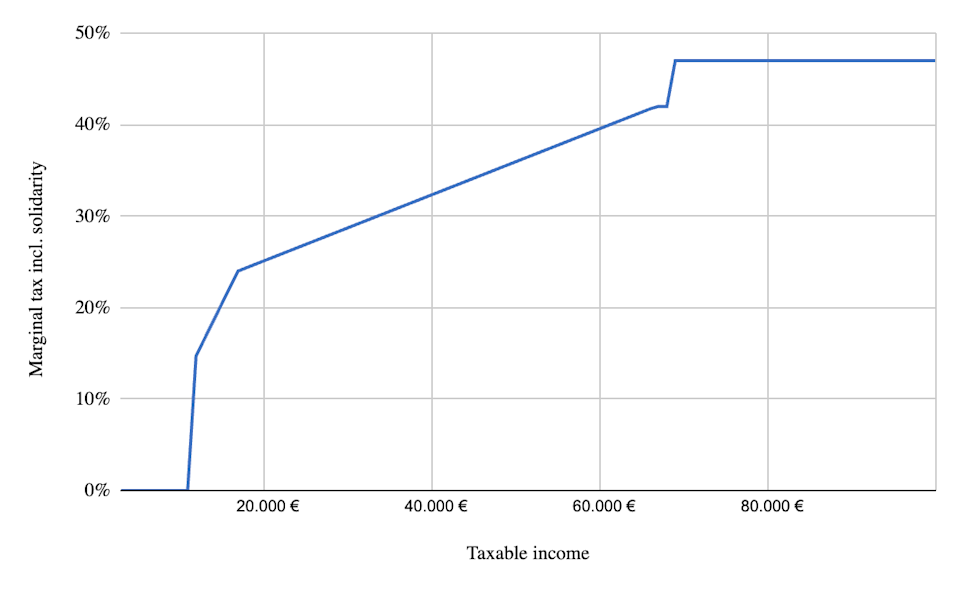

Your Marginal Tax Rate: In Germany's progressive tax system, your income is taxed the higher your income is. The marginal rate is the tax rate you pay on your last euro of income. Your taxable rental income is effectively taxed, or returned to you, at about the highest rate you pay. We estimate your marginal tax rate, given your gross income of 88.000 € as 43,44 %.

Marginal tax rates in Germany

This includes the solidarity tax. In the 42% bracket, your marginal tax rate is actually 47%. This is because the solidarity tax is not applied to lower incomes and is about 10% across middle to higher incomes, so it averages 5% at higher income levels.

How this affects your results:

High‑income earners benefit more because deductions apply at a steeper part of the tax curve.

Depreciation reduces your income tax and, in essence, returns you part of the purchase price. The higher your tax rate, the more of the purchase price you get refunded.

How High is Property Depreciation in Germany?

How much you can depreciate over time for different types of properties with different depreciation rules, you can see in the following graphs.

Cumulative depreciation percentage

The depreciation (AfA) rules are discussed in detail below, but in brief, you can distinguish

2,5 % linear depreciation on properties (built before 1926)

2 % linear depreciation on properties (built between 1926, and 2022)

3,0 % linear depreciation properties (completed after Dec 31, 2022).

5% degressive appreciation properties (completed between Oct 1, 2023, and Sep 30, 2029)

5% 4 year bonus depreciation properties (completed between Dec 31, 2022, and Sep 30, 2029)

Lower your taxes in Germany

A real estate investment is an attractive way to build wealth and minimize your tax burden.

Explore our projectsYou can see that for the most advantageous buildings, those with bonus depreciation, you can depreciate 25 % over 10 years. At your tax rate, this would lead to a gain of 43,65 %. In the case you consider, you depreciate 45,23 %, and after 10 years, you have 59,5 % left to depreciate.

For the special bonus depreciation properties, your cash layout can be very modest. This implies that returns on invested capital can exceed 20 %, well above the 3-5 % return on a long-held property.

Keep in mind that eventually, after paying off the loan and when you run out of depreciation benefits, the overall net return of a property declines to about 3 % appreciation value plus 1-1,25 % in rental yield after you consider tax on the rent and the maintenance cost.

Thus, over time, your return on your capital declines to a level that is far less than the return you get on newly invested properties. This implies that, from a financial perspective, you should not hold your rental properties for too long, as we discuss in detail below.