See what you can afford in Frankfurt an der Oder

As a leading Mortgage Broker in Frankfurt an der Oder,

we're here to help you find the right mortgage.

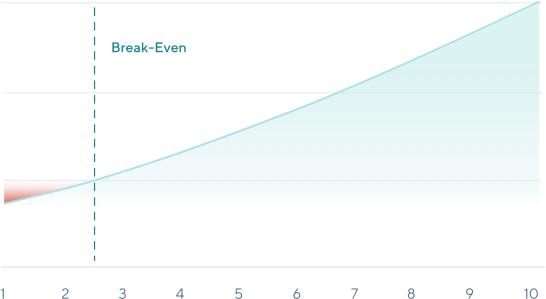

Should I rent or buy in Frankfurt an der Oder

Would buying or renting a property in Frankfurt an der Oder make sense for you? You can use the simple rent or buy calculator that Hypofriend has designed to evaluate your case.

What are the current mortgage rates in Frankfurt an der Oder

Whether you are buying a property as a primary residence, second home or investment property, every state in Germany has their own singular purchase fees.

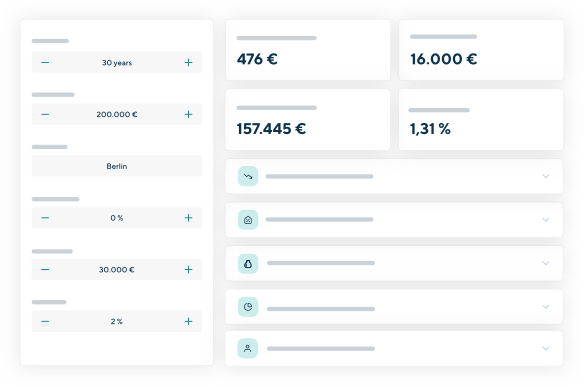

Mortgage calculator for Frankfurt an der Oder

This German Mortgage calculator helps you understand how fast you should pay back your mortgage. One of the key decisions for your mortgage is choosing how quickly to repay your mortgage.

Looking for a mortgage broker in Frankfurt an der Oder?

Our team of experts will support you with buying a property in Frankfurt an der Oder, whether that's in-person or via our proprietary video consultation software.