We work with 750 mortgage lenders to find you the right mortgage.

We compare all mortgage platforms

We compare offers from more than 750 banks using Europace, eHyp, and Baufinex to find the best deal.

Most brokers just use a single platform.

We had an amazing experience with Hypofriend! They helped us secure our mortgage quickly and smoothly, guiding us through every step of the bank process with clarity and confidence.

Panos

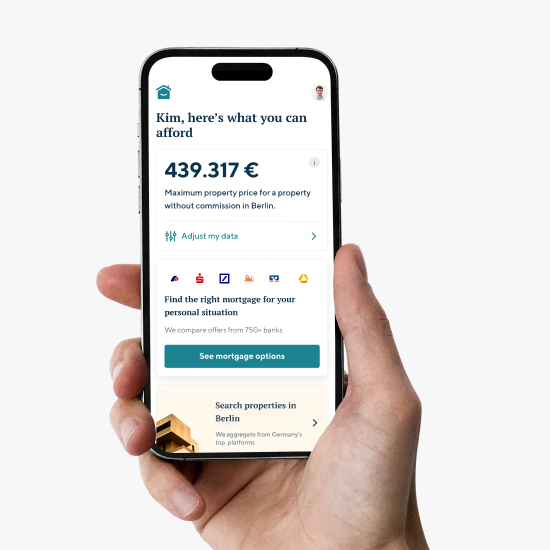

Easily check what you can afford

Just answer a few questions to see what you can afford and where you qualify

Our service is free as we're paid by lenders

I found their service quick, efficient and good value. Timur Köhler has made almost impossible - improved the interest rates several times! English language skills were excellent. Very helpful when I had questions. Nice people to work with. Would definitely use again.

Elena Kondaleva

product based on your circumstances.

We'll find you the optimal mortgage

Our recommendation engine calculates your optimal mortgage comparing hundreds of lenders and thousands of loan options

They have been very helpful in navigating the complex process of getting a mortgage in Germany. All has been very structured and clear from the beginning, and all the resources and tools that you can find in their website are a great example of how technology can enable a better experience for a customer

Francesco Polentini

We'll consult you over video for free

Our mortgage advisors will guide you through your options using our proprietary video consultation software, helping you to understand, find and apply for the right mortgage.

I would highly recommend Hypofriend to secure the perfect mortgage especially for first time home buyers. Our agent Janik guided us through the whole process and was always ready & willing to provide us with detailed answers. Thanks for making our home-buying experience a smooth and enjoyable one!

Poornima Vadivel

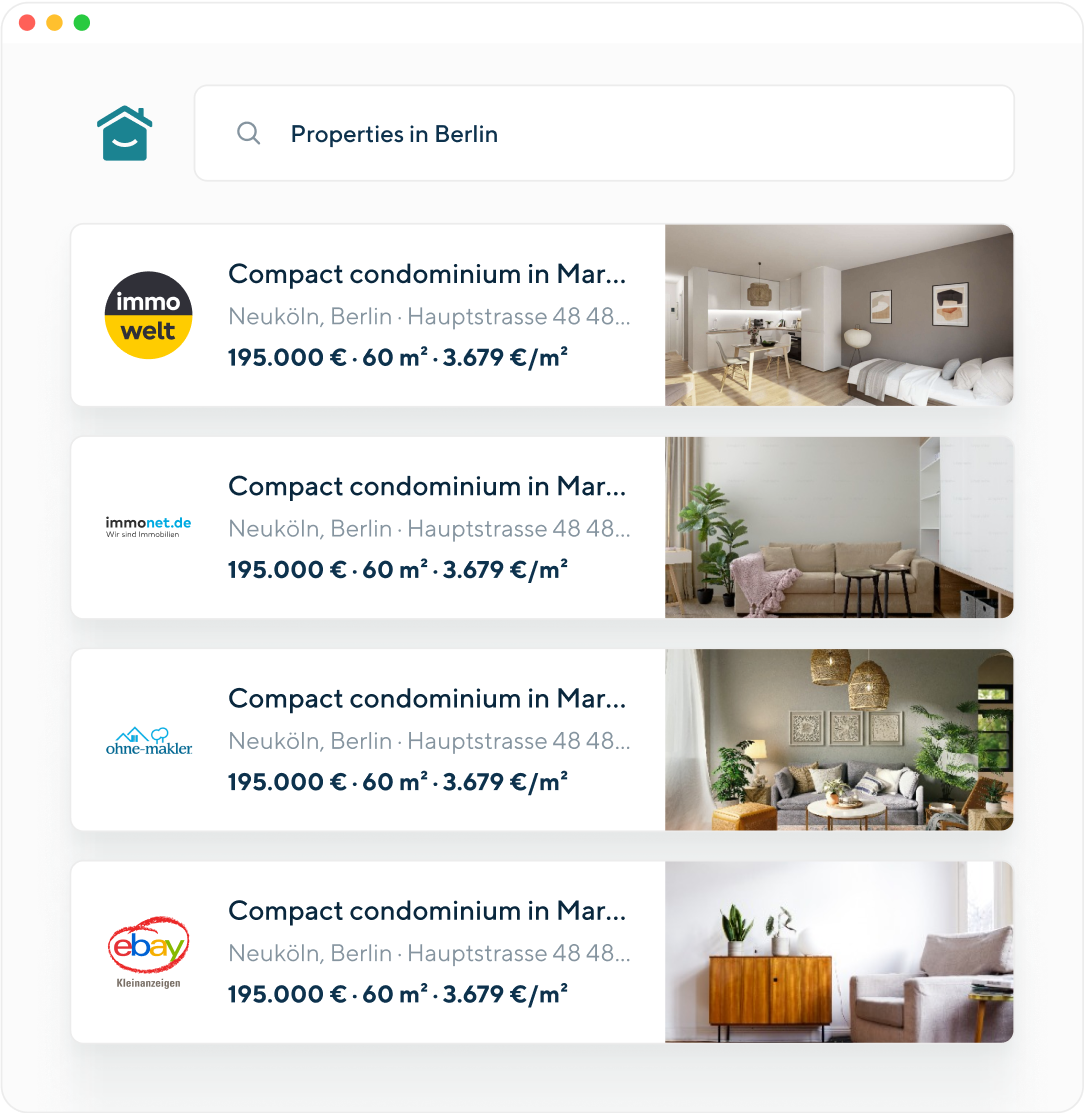

Find all of Germany’s properties in one place

Our property search engine combines offers from all major platforms and notifies you of new listings based on your search preferences.

Hypofriend have been an invaluable guide throughout our buying process. Could not recommend highly enough. Trustworthy, reliable, patient and transparent. Incredible guides through what can be a complex, and opaque process.

Ben Cross

What Our Clients Say

Don't take our word for it. Over 250.000 have used Hypofriend and we've supported 1.000s of people with finding and financing their dream home in Germany.

Our meta-search engine finds the optimal mortgage for you

The combination of our meta-search engine, valuation tools, and consultation technology helps us find the right mortgage for you from over 750 banks.

Do you still have questions?

We've got answers.

Is the service free?

Yes, our service is always free. Just like any German mortgage broker, we get paid a standard commission by the lender for processing a successful mortgage application. This commission will always be paid by the lender and not by you the customer. As a privately owned and independent company we strive to always deliver the best result for our customers without compromising our values.

Who is behind Hypofriend?

Hypofriend was founded in 2017 by Nick Mulder, his father Dr. Christian Mulder, and later on Pavel Jurasek to help customers make smarter mortgage decisions. Together with a team of over 50 engineers, economists, and mortgage experts they have helped hundreds of customers understand mortgages better and realize their dream of buying a property in Germany.

How does it work?

Start by calculating what you can afford, our Property Radar will then suggest properties you may be interested in. Or simply fill in the details of the property you'd like to finance and we'll calculate your optimal mortgage, advising you on how long to fix the interest rate, how quickly to repay your mortgage and how much equity to invest. We'll then apply you for the best mortgage. You will typically get your mortgage approval within 3 to 10 working days.