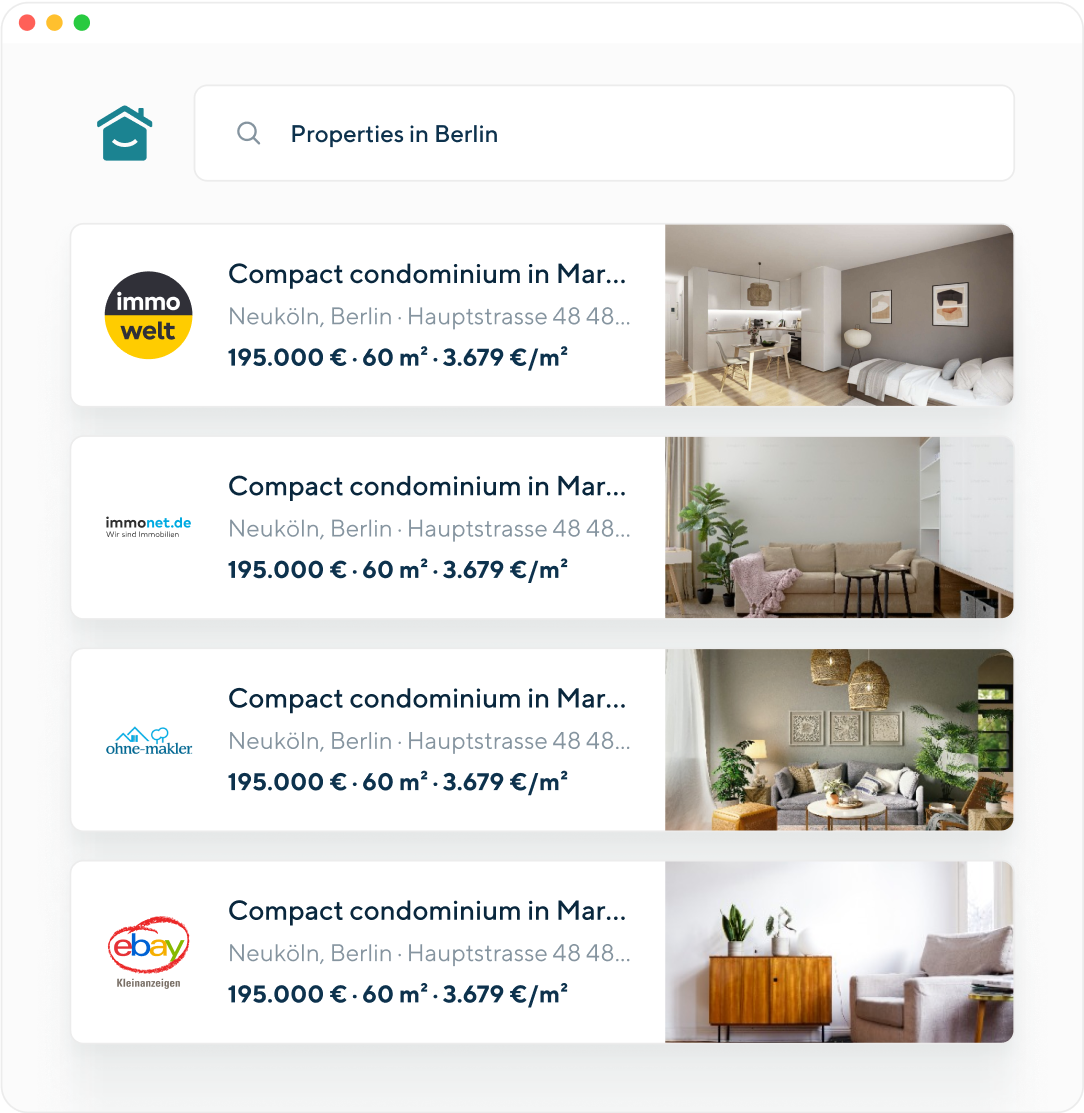

Easily check what you can afford

Just answer a few questions to see what you can afford and where you qualify

Our service is free as we're paid by lenders

I found their service quick, efficient and good value. Timur Köhler has made almost impossible - improved the interest rates several times! English language skills were excellent. Very helpful when I had questions. Nice people to work with. Would definitely use again.

Elena Kondaleva